Just when it seemed that the world was recovering from its past financial scandals, in only weeks another one emerges. So far in 2012, first JP Morgan Chase announced the loss of more than 2 billion dollars due to trading errors relating to credit derivatives (in later revisions, the loss was estimated at closer to 9 billion dollars). A few months later, there was news that the practice of manipulating the LIBOR rate, which was seen in 2008, seems to have continued to the present, and that the world’s largest banks had been understating borrowing costs to avoid revealing their true financial position. We now know that several banks, among them Barclays, city and J.P. Morgan, submitted incorrect information to the central banks.

Major financial scandals over fraud, mishandling or simple errors of perception are not new. But the number and frequency with which they occurred in recent years have heavily damaged confidence in the financial industry throughout the world. The destruction of savings caused by neglect or ethical failures have affected large and small investors alike.

In this disheartening climate, we spoke with Javier Domenech, president of the CFA Society of Mexico, to learn about the global initiatives that the CFA Institute has developed to restore trust in the financial markets. Javier is also director of long-term debt at BBVA Bancomer Asset Management and Professor in the Master’s degree program in finance at Universidad Anáhuac. He has 18 years of experience in the financial industry in Mexico and New York. He has an undergraduate degree in industrial engineering from the Universidad Anáhuac, an MBA from the University of Michigan and has earned both Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) certifications.

The CFA Institute and its chapter in Mexico have recently assumed a much more active role in promoting and defending ethical behavior in the investment markets, not only establishing guidelines, but identifying and reporting unethical behavior. In May 2012, the Institute published a document entitled “The Integrity List: Fifty ways to restore trust in the investment industry.” The document contains 50 tangible steps through which investment professionals can help rebuild confidence in the industry. This trust needs to be restored from within and from without, and only daily actions by the professionals that participate in the markets can make this happen.

In your opinion, and in the opinion of the Institute, how did we arrive at such a severe crisis of confidence? After 2007-2008, it would seem that industry participants completely abandoned their fiduciary responsibilities to their clients and employers. How did the situation get this bad?

Well, I believe that the crisis of confidence is largely part of the result of what originally generated crisis and got worse from there. Really, if you see the crisis from the standpoint of the general public, a lot of trust was lost in the financial system. Specifically, people were hit on two sides. First, those that invest in real estate lost their home and may have taken a loss, but they also lost money on their investments. I think it all came from the fact that the interests were highly divided, and everybody was looking out only for themselves. Everyone was watching their own back. Every industry just saw its own little piece, without seeing the whole picture. You have a real estate broker who earned a commission just for selling an apartment, and all he was interested in was that. You have a person who originates the mortgage and just charges a fee to place the loan, that person is only interested in volume, not quality. Then you have people who packaged debt, and those people just made money on the volume, and the rating agency charged a commission to rate, and at the end of this chain there was an investor whose only interest was buying paper as long as it was rated. Bit by bit, the quality of the origination began to deteriorate. Actually, nobody acted dishonestly in this process, but everybody was interested solely in turning over a high volume of business, without really looking at everything that was happening.

After this, obviously, the industry looked very bad. A lot of people lost money, their savings, their homes, and then there was the stock market crisis. Time went by and there is still tremendous disillusionment with the financial industry in particular. Something else that has been surprising over time is that this crisis has dragged on, and scandals keep cropping up. The most recent one is the LIBOR rate, which is a very delicate issue because this rate is used to put a price on a great many credits and a great many derivatives. There are 500 trillion dollars in derivative products whose price is set according to the LIBOR. The truth is the new scandals keep coming and coming. With the LIBOR rate, we’re talking about the same dates and probably the same causes of the 2007-2008 crisis. The problem apparently arose because during the crisis, banks did not want to disclose any of their problems.

In light of the great number of financial scandals, the Institute made a list of what it calls “50 measures to restore trust in the investment industry.” Basically, the list was put together with industry practitioners. The Institute brings together a large number of investment industry participants, and that’s how it came up with this list.

So there are errors, there are incorrect decisions and there is negligence in the processes. Where is the line that separates errors from ethical failures and fraud? The general public, which is the client of the financial system, wants to know: how much of it is an outright crime, and much is simply human error?

Yes, of course. Actually, I believe we have to analyze what happened on a case-by-case basis. But one thing that is very important is to turn around and examine, on a global level, if the little piece that each one handles effectively produces a benefit for society, and if interests are aligned. There is even a distinction, for example, between the problems faced by the industry on a global level and what is going on with J.P. Morgan, which is a more local problem. At the local level, we have not seen scandals of this type, and in fact, I think that regulations are much better here. Local issues are really a whole different matter.

Now, where is the fraud? I believe you have to analyze on a case-by-case basis, and that’s where the legal system comes in, and this can be very difficult to prove. I think it is important that in the industry, the people are trained, in principle, and to the extent possible, that the clients’ interests are aligned with the interests of those serving them.

One of the components of the CFA Institute code and standards of ethics is that professionals should do their jobs carefully and diligently, and the processes are well aligned. The Institute is very insistent on this, and now the “list of 50 steps” underscores the fact that errors cost so much money that doing your job with diligence, care and dedication is actually an ethical issue. The Institute encourages professionals to take responsibility for protecting the interests of clients and fulfilling their responsibilities with their employers, and avoiding allowing this type of problem or large-scale error to occur.

Obviously, I share in this effort to promote ethical behavior. I believe that the ethical approach and relevance of this Institute comes from the fact that when professional standards of conduct were originally developed, they were done with an eye to sound business practices. This was an important topic in which people that were studying finance had to be educated. With this recent crisis, this issue has become much more important, and for the Institute, it is good to be viewed as a benchmark of high ethical standards in this crisis. Hence its decision to come out with this list of 50 ways to restore investors’ trust. Something this Institute is interested in doing is to serve as a kind of “bolder voice.” In other words, a stronger voice, because before, an ethical person was one who did their job well, but now the position the Institute is taking is that the person must also point out when things are wrong. This is, I believe, the new direction that this list represents. Before, it was totally focused on what we should be, and many of the points on the list continue to be about what we should be, but now it also moves us in the direction of becoming a more critical voice about what is wrong in the industry. It even encourages us to work with regulators on determining where we need stricter regulations, in other words, criticizing. This criticizing the bad things about the industry is an important point; it’s something that was not seen before.

How did this initiative come into being? What was the motivation?

The list was first published in the annual conference of the CFA Institute in Chicago in May 2012. What we did was to seek out ideas from all our members on how we could restore confidence in the investment industry. We received more than 1500 ideas and then later, through a huge effort, we compiled all these ideas into these 50 points. Many of those original ideas were probably duplicated or represented two sides of the same case. Finally, we came out with a list, and the idea is to send a strong signal to regulators, investment companies and professionals to work together and restoring investor trust. That this be at the top of their list of priorities.

Was the list created in blocks, following the seven ethical standards of the Institute, or was it not necessarily so detailed, presenting general ideas instead?

Actually, they are general ideas. The code of ethics and standards of professional conduct are list of things that must be done in the industry, and obviously there’s a lot of overlap in many of the points. For example, the code of ethics contains the obligations to employers and to investors, and one of your obligations to investors is placing their client’s interests above your own, and this is something that you will find both in the code of ethics and in the list. This is the kind of overlap we’re talking about. But there are things that are not in the code of ethics and that “the list” says are elements that need to be addressed to restore trust. For example, the use of social media to publicize your values, writing articles, speaking to the public about ethics, in other words, becoming a stronger, more critical voice on ethics or on ethical topics. These are important elements for restoring competence, but they are not included in the code of ethics. Many of the points on the list coincide 100% with the code, like making a commitment to ethics, staying up to date with the latest regulations, knowing and applying regulations, etc.

The first 10 points on the list are in boldface. Was the intent to give them greater emphasis?

Obviously they wanted to make a distinction about these first 10 points, and I believe these 10 things are the first things that everyone can do. They are actions that can apply to everyone, while the others depend on the situation. For example, if you don’t have contact with clients there will be some points that don’t apply to you. But the first 10 are something that everyone, to the extent possible, can do from where they are. Even so, although we wanted to place a little more stress on the first 10 points, this does not detract from the importance of the other points and probably, in the specific situation of one professional or one brokerage firm, the subsequent points could be much more important. We did make a small distinction for the first 10, but it is not a very profound distinction, it’s rather question of stressing that at least we have to act on these 10 tangible steps and try as hard as we can to apply the rest of the 50 within our own sphere of professional activity.

How does the Institute perceive its responsibility as a professional association? The Institute establishes principles, expresses opinions, but when it comes time to put them into practice, how do you, the certified members of the Institute, view responsibility of housecleaning from the inside? Have certified members made a pledge, and belonging to the Institute, about taking responsibility for cleaning their own house?

The Institute, as the name indicates, is an Institute. It was first created as an educational institution and I believe it has been transformed into something that is much more than that. Part of this transformation was precisely this intent to promote ethical values and, in this sense, the Institute is doing a huge job as well as it can. First off, it encourages all industry participants to adopt sound corporate practices. It also urges members to adopt a code of conduct and the integrity list, and maintains very good relations with many regulators around the world. Our relationship with regulators has been very fruitful, because these are also interested in promoting the Institute’s ethical standards in their markets. In this regard, there has been a very strong sense of common purpose. From there, putting this into practice in each of the countless industries and practitioners involved in this market is an additional step. Working hand-in-hand with regulators enables us to work on restoring confidence from the regulatory standpoint. In brief, the job this Institute is doing, and our relationships with regulators of all the countries where we are present, are truly remarkable.

Point 36 on the list makes a distinction between “earning money” and “making money.” How do you see this distinction?

The financial services industry is the custodian of and has a fiduciary duty regarding practically all of the people’s monetary savings. That is why it collects fees and commissions. Basically, what this point is saying is that you should try to charge fees and commissions that are appropriate the product or service that you are providing. Even at the level of the Institute there was a discussion about whether commissions should be charged on highly liquid products, and what commission would be fair. For example, if you create a huge infrastructure or need a very large infrastructure to reach individual client, may be a commission is justified, but if you’re a small investment office that takes some money and invests it overnight, your cost for doing that is very low, and if you charge very high commission, in that case you would be “making money” but not “earning money.” If someone is doing that, they might be very profitable, but really the products and services they are providing do not justify charging a consultancy fee.

So this is something that is directed at people who offer financial services, not so much for investors. What you’re telling us is that on this point you’re insisting that ultimately, you should charge what is there for your services? If your services require an in-depth analysis, financial engineering, complex structures, then you have every right to charge high commissions and keep some of the returns. But if, as you explain it, you’re simply investing in overnight treasury certificates with no complicated strategy, the service does not cost much and you shouldn’t charge much for this service.

Exactly. I believe that in this case it is justified if you do it for the overall investing public and need, like Mexico’s major banks, thousands of branches, then you have to reflect some of this cost in your commissions. But I believe that each institution is responsible for deciding how much of this cost should be reflected, and put a price on it.

To conclude, now these tangible steps are in writing, what’s next for the Institute? What is next for the CFA Society of Mexico? You have recently been appointed president, congratulations, by the way. What’s next for you?

It’s not very different for the Institute and for the Mexican chapter. If you are a “bolder voice,” you need to be heard by the right people. Who are the right people? The first ones that are going to hear you, and this is pretty easy, are the members of the Institute, and is important that the members play an active role in the Industry. Industry participants in general are those who are more involved in implementing ethical practices in the elements of the integrity list. At the next level are regulators, who also have an interest in promoting these standards through ethical education, and regulators must also encourage competencies. This is done by issuing regulations, rules, and sanctions for those who do not exercise ethical practices. Also, the Institute has a good relationship with universities, and I believe that is another way we can pursue this ethical orientation.

At the level of the Society in Mexico, I want to point out and recognize the great job that Ana Cecilia Reyes Esparza did at the event commemorating the 50th anniversary of the CFA Institute and the 20th anniversary of the Society in Mexico, on May 29. There was a panel in which Ana Cecilia commented to regulators on this integrity list. She read through some of the points that seemed personally more important to her and mentioned that she would turn the list over to regulators for them to become familiar with it. This was very good way to disseminate the list in Mexico, because every peso that is invested and regulated in Mexico was present and represented at that event. Participating institutions included the National Retirement Savings System Commission (CONSAR), the Mexican Bankers Association, the National Banking and Securities Commission (CNBV) and the National Insurance and Bonding Commission (CNSF). Practically every area of finance in Mexico that is regulated was present at the event, in addition to the chairman of the Mexican Stock Exchange. This forum seemed to me very interesting as a starting point for promoting the list and we obviously will continue to promote it in all the events we organize as a society.

Any final remarks?

I’d like to thank you for this opportunity, and point out that the local level, as an industry, we are in a much better position than many other financial industries around the globe. I’d also like to commend Mexican regulators for their good work. Perhaps something I would like to see particularly at the local level is more competition in the industry. But, in general, all the participants we have here in Mexico–banks, pension funds, mutual fund managers and investors–are all reasonably well regulated and it is important to bear this in mind. About this list, there is always work to be done in restoring trust in the financial industry, but in Mexico this trust is not in as bad shape as it is in other parts of the world, and even seeing it from the inside, I myself have a lot of confidence in this industry and in the people who are working to make sure we continue to earn this trust.

References

CFA Institute Integrity List:50 Ways to Restore Trust in the Investment Industry, mayo de 2012. http://www.cfainstitute.org/about/vision/serve/Pages/integrity_list.aspx

Code of Ethics and Standards of Professional Conduct, http://www.cfapubs.org/doi/pdf/10.2469/ccb.v2010.n14.1, CFA Institute, junio de 2010.

Standards of practice handbook, 10th edition, CFA Institute, 2010. http://www.cfapubs.org/doi/pdf/10.2469/ccb.v2010.n2.1

About the CFA Institute and the CFA Society of Mexico

The mission of the CFA Institute is to lead the investment industry in establishing the highest standards of ethics, education and professional excellence. The organization provides education to investment professionals using its Global Body of Investment Knowledge(TM), which encompasses all aspects of the investment profession, including ethics. At present, the CFA Institute offers two education and accreditation programs: The CFA program, which offers the title of Chartered Financial Analyst® (CFA®), and the Certificate in Investment Performance Measurement (CIPM), which offers the title of CIPM®.

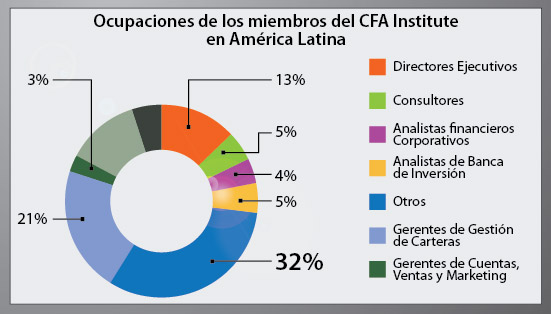

The CFA Institute has more than 110,000 members in more than 135 countries, 90% of them CFA certified. In Latin America and the Caribbean it has more than 1,200 members, including 87 members in Mexico. Our members are employed in a wide variety of positions and include professionals in investment portfolio management, research analysts, executive directors, consultants, investment banking analysts and account managers.

One Trackback

[...] años ha deteriorado significativamente la confianza en la industria financiera en todo el mundo. leer más… //// « Coaching: El Día de [...]