By: Nathan Moussan

Introduction

The purpose of this article is to provide an analysis and diagnosis of the current status of the Mexican corporate debt capital market and its recent evolution, and on this basis, to the weigh the benefits for companies of obtaining short and long-term funding through the debt capital market. The public market offers many opportunities to guide mid-sized and large companies in assembling a package of measures for managing their liabilities, in order to obtain different funding alternatives, and thus to improve their financial costs.

Companies take on debt for many reasons. The main reason is that debt can be cheaper than internal financing, because, generally speaking, investors demand higher yields. The company’s management must decide how and where to raise the funds they need to attain their growth goals, whether through private sources, loans from financial institutions like banks, or through the public markets, which involves placing securities on the debt capital market to be acquired by investors.

Issues of corporate debt in Mexico generally take the form of Certificados Bursátiles or debt certificates, which provide operating flexibility by enabling companies to obtain funding through one or more issues within an overall placement program. The company can decide on the most appropriate amount, timing, and characteristics for each issue. They can also set the size and general payment conditions, such as interest rates.

Background

The international financial crisis that broke out in United States in 2007 with the subprime mortgage debacle produced structural changes in the way Mexican corporations raise funding. In September 2008, with the announcement of the breakup of Lehman Brothers in the United States and Comercial Mexicana’s default in the Mexican market, access to bank credit dwindled a mere trickle, and issues of commercial paper became the only available source of funding for some investment-grade firms, although the financial costs were high and the terms extremely short.

But thanks to support programs introduced by the Mexican federal government in 2009, like partial guarantees from the Sociedad Hipotecaria Federal (Federal Mortgage Agency) and NAFIN/Bancomext, Mexico’s corporate debt market recovered more quickly than expected. In that same year, Mexican corporations were able to restructure most of the financial liabilities that had experienced payment problems. Non-bank banking institutions called Sofoles dealing in mortgage loans ceased to be one of the most important sources of funding and many of them went to default.

In 2010 and 2011, most issues were long-term, fixed-rate paper, placed by corporations with different rating levels to take advantage of extremely low funding rates in Mexico. Starting in 2012, banks have become once again more involved in the lending activity, because institutional investors have been more selective with corporations and have been investing only in high-grade credit issues.

Evolution of Mexican corporate debt

Most Mexican corporations that were facing short-term debt maturities, lacked liquidity or external sources of financing ended up restructuring their liabilities to extend their maturities to longer tenors. Although lenders were rewarded with higher spreads, much of the restructures were based on floating rates, so in a cycle of declining interest rates in Mexico, funding costs have dwindled overall.

Additionally, major corporations that already had a healthy financial position and liquidity took advantage of the downward cycle of Mexican interest rates, and in 2009 these corporations were highly active in the debt capital markets, issuing long-term debt and raising low cost funding to finance long-term projects.

The Mexican corporate debt capital market has undergone sweeping transformations and gone through a boom in recent years thanks to a stable macroeconomic climate and low interest rates. It has withstood the recent turbulence of the global financial crisis and is receptive to issues with the highest credit rating.

In 2010, a record 253.3 billion pesos went out on the Mexican debt capital market, from issuers such as Pemex, America Móvil, Telefónica, Peñoles, Televisa, among others. Investors showed a keen interest in corporate issuances, acquiring a heavy volume of debt issues in diverse sectors. In spite the prevailing climate of market volatility, in 2011, total placement volume on the long-term corporate debt capital market declined by 11.2%, totaling 224.90 7 billion pesos. In the first seven months of 2012, debt issuances once again dropped from the year-earlier period, due to the absence of recurrent issuers such as Pemex, financial institutions, and structured issues.

Meanwhile, the amount of commercial paper-with issue terms of up to one year-outstanding on the market also diminished sharply starting in October 2008, after reaching its highest level in recent years in August 2008, when the outstanding amount was 76.95 billion pesos. In 2009, outstanding amounts were lower than their year-earlier levels, because corporations, particularly in the automotive industry, stayed out of the debt market, and the climate remained difficult for mortgage sofoles. The financial crisis dried up market liquidity, increased spreads and reduced the size of offerings placed by major issuers.

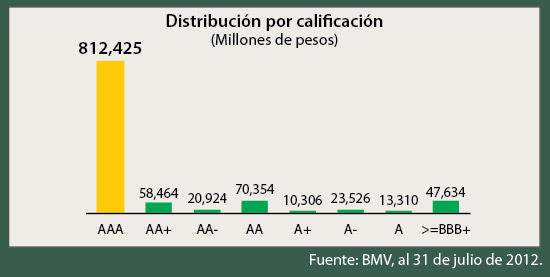

Since the crisis broke out, only issues with the highest credit ratings have been able to access the debt capital market. This phenomenon was caused partly by some high-profile defaults: Comercial Mexicana, Metrofinanciera and Hipotecaria Crédito y Casa, which caused investors, both institutional and retail, to become more cautious about the financial strength of the companies in which they invest. Issues rated AAA account for 76.9% of outstanding private debt amount, while issues rated AA+ and AA account for only 12.2% of the total volume.

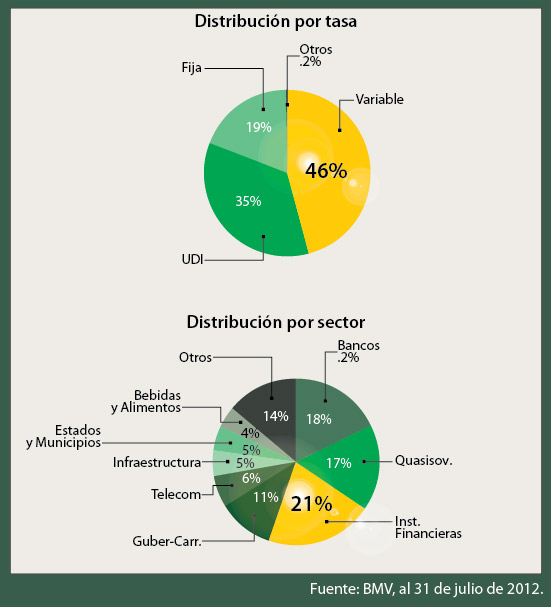

The market has recently seen a preference for longer term fixed-rate issues, taking advantage of low interest rates. Of the current issues of long-term corporate debt, 65% are denominated in pesos and remaining 35% in UDIs (inflation-indexed “investment units”). Floating-rate issues make up 46% of the total (pegged to the 28-day TIIE), inflation-indexed issues 35% and fixed rate issues 19%. Furthermore, 81.0% of the outstanding amount of long-term issues is represented by only 10 issuers. The largest proportion of outstanding debt on the local debt capital market corresponds to state-owned enterprises like Pemex, CFE, and Infonavit, which account for 34.0% of the total, followed by financial institutions and banks, and then telecommunications firms.

New products

New products have come out of the Mexican market since 2009, like equity certificates known as CKDs or Certificados de Capital de Desarrollo, which attract financing from institutional investors, primarily pension funds and insurance companies, and channel it to trusts, which in turn support projects with long-term growth potential, such as infrastructure, energy, real estate, industrial, toll roads, or private equity to support for mid-sized companies with the potential for medium-term growth.

CKDs are hybrid equity-long term debt securities, similar to equity instruments in that there is no obligation to pay principal or interest. The yields on these securities are tied to the profit generated by the assets, goods or rights, and their holders are entitled to the products of the investments made, or the proceeds of their sale. CKD issues do not require an official rating of their credit quality, nor of the issuing trust or trust creator. At least 20 individual investors must participate in each placement, and the issuer must comply with the corporate governance regime that grants rights to minority bondholders.

This new asset class implies a higher risk, but also offers higher potential yields. Today, 20 CKD issues have gone out on the market, totaling 50.40 billion pesos. The most important thing is that the complexity of these instruments is translated into a language more easily understood by investors.

So far in 2012, four CKD issues totaling 8.20 billion pesos have been placed. These issues began legal documentation filing in 2011, enabling them to negotiate in advance with pension fund managers. The issues have incorporated adjustments to the regulatory framework regarding the mechanisms of capital calls, minimum number of participating investors, and pension fund investment criteria.

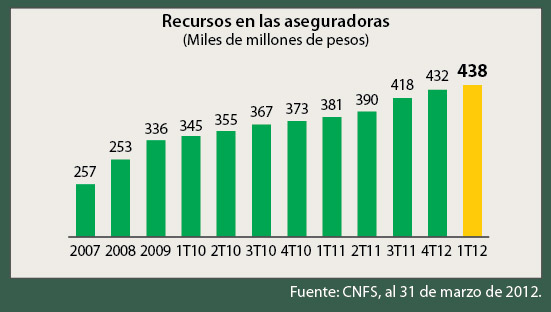

Institutional investors

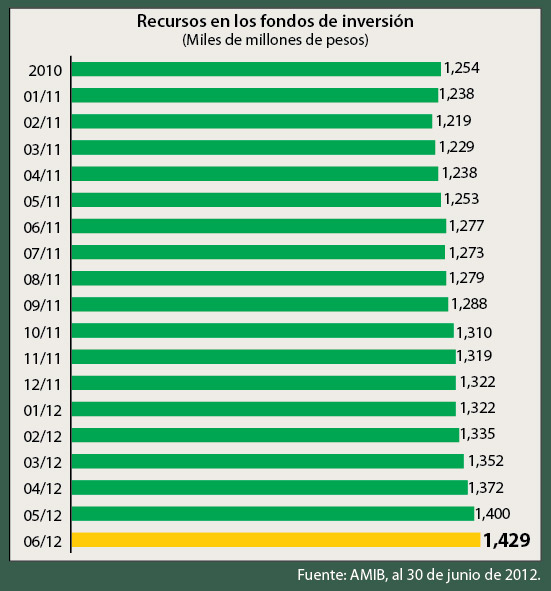

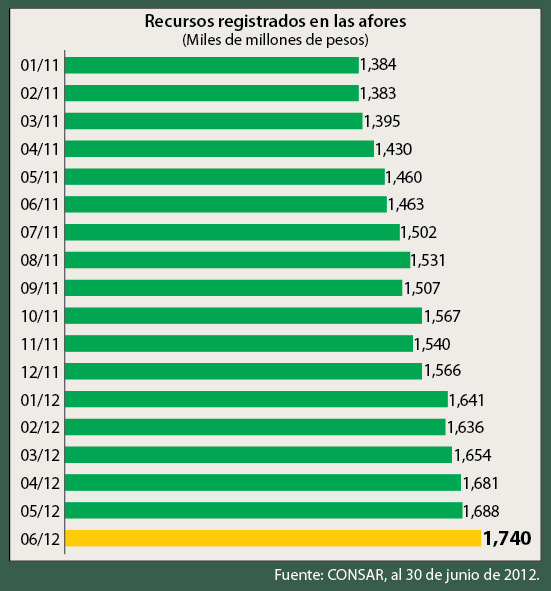

The Mexican debt capital market has grown in recent years, and one of the main reasons for this has been the expansion of institutional investors’ portfolios. Pension funds called Afores, mutual funds, insurance companies, corporate pension funds and bank treasuries have all substantially increased the amount of their assets under management available for investment. As of June 30, 2012, these institutions had a total of 4020 billion pesos, 815 billion of which were invested in corporate debt, or 21.0% of the total amount. The main bondholders are the Afores, which held 32% of the total amount of corporate debt outstanding.

Generally speaking, liquidity runs high on the local debt capital market. The Afores receive an ongoing inflow of contributions from workers and have found few investment options beyond government and financial institutions’ debt. At the close of June 2012, total assets under management by institutional investors (pension and mutual funds) totaled 3169 billion pesos, equivalent to approximately 20.4% of Mexico’s GDP (estimated as of the second quarter of 2012). This is 15.7% higher than in the same period of 2011.

Conclusions

In general terms, the local debt capital market enjoys a high level of liquidity, because there is a strong demand from investors but a limited supply of new issuers; however, the base of investors in Mexico is highly concentrated, compared to international markets. Pension funds portfolios are heavily diversified across various types of assets, issuers and regions, because of a widespread easing of investment regimes, including authorization to invest in productive projects, which has allowed them to obtain attractive yields while in turn serving as a source of funding for Mexican companies.

References

INEGI, Estadísticas Históricas de México, México, 2012, disponible en http://www.inegi.org.mx.

Banco de México, Estadísticas, México, 2012, disponible en http://www.banxico.org.mx.

Bloomberg, Página principal, disponible en http://www.bloomberg.com. (Última consulta, 3 de agosto de 2012.)

Bolsa Mexicana de Valores, S.A.B. de C.V. México, 2012, http://www.bmv.com.mx.

Boletín Estadístico de Banca Múltiple, Comisión Nacional Bancaria y de Valores, junio de 2012.

Graphs and tables

2 Trackbacks

[...] EstratégicaCarrusel « Mercado de Deuda Corporativa en México Versión para imprimir 0 Comentarios [...]

[...] con vistas a acercar posiciones y poder llegar a un acuerdo que sea beneficioso para todas. leer más… //// « Reflexiones sobre la Infraestructura como Estrategia Promotora de [...]