By: Alex Horenstein and Alejandro Saltiel

Business School

ITAM

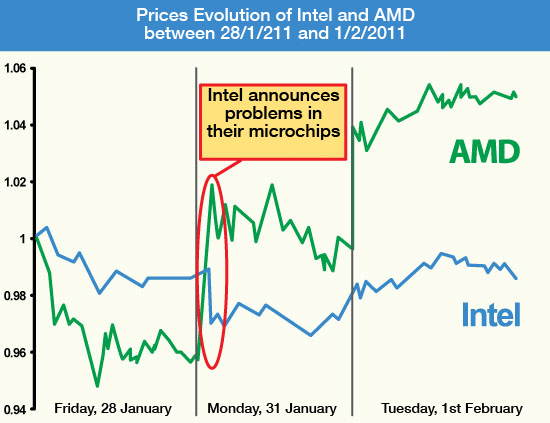

Diversification is one of the better known concepts in managing financial asset portfolios. According to the popular saying, diversify is “not to place all the eggs in the same basket”. The basic idea is that if an asset in a portfolio loses value, the investor has others to attenuate the impact of the loss. In other words, to diversify allows us to minimize the exposure of our portfolio against specific assets risk. (The only diversifiable risks are the specific risks. Risks common to all assets, the also called systematic risk, are not diversifiable). For example, on Monday, January 31, 2011 Intel informed that a failure in one of its new microchips will make it lose up to 300 million dollars (700 million according to some analysts). A portfolio that includes only Intel would have lost that day part of its value. Instead, a well diversified portfolio with other technological companies would not have to lose its capital. It could even increase its value since a loss for Intel may mean a gain for its competitors. In the following graph you can see the evolution of Intel and its more direct competitor, AMD, the day before, during and after this news was made known.

Graph 1

In Graph 1 one can clearly see how on the day Intel announced the failure mentioned herein above, its price was negatively affected and AMD obtained positive returns. Actually, the AMD value increased more than what Intel lost. Therefore, a portfolio with exposure to the microchip industry diversified in equal parts between both companies would have obtained positive returns, despite Intel’s negative news.

However, not all diversification ways are equally efficient nor do they have the same costs. If one would like to replicate the Standard & Poors 500 (S&P 500) Index that has the 500 companies listed, more capitalized in the United States, one should buy 500 shares and pay 500 individual commissions (one per each company included in the Index). Subsequently, in order to sell the portfolio one would have to pay 500 commissions to close each transaction. Luckily the technological and financial innovations offer a more economic alternative: the Exchange Traded Fund or ETF.

These are funds that try to copy the performance of a specific index or several stocks. They are valued as funds, but they are exchanged as common and ordinary stocks. In the S&P 500 case, one can directly buy the ETF called SPDR S&P 500 (ticker: SPY), at a cost similar to that of a common stock.

The variety of ETFs in the market is bib and it continues to grow. One can buy ETFs that replicate the value of the stock exchange indices of practically all countries. Likewise, there are ETFs that follow the value of previous metals, commodities, bonds, currencies and all assets that have a marketing value. This allows us to obtain well diversified portfolios at a very low cost.

In order to be well diversified, one can replicate not only one of the stock exchange indices of a given country; one can also have a portfolio that replicates the returns of a combination of all kinds of global assets. This allows investors to minimize their exposure to the specific (and avoidable) risks of the different assets.

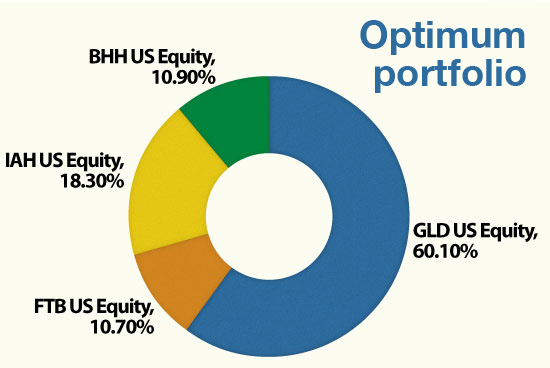

To illustrate the concepts mentioned above, an optimum portfolio was made, defined as the portfolio that has the highest return possible for a specific risk level, the return, as the mean of the portfolio’s monthly returns in the period of time analyzed and its risk, such as variability (standard deviation) of that return in the same period of time. This portfolio uses standard techniques and date from July 2006 and July 2010. Four ETFs were selected to calculate the portfolio. The first one is GLD US Equity that exemplifies the return of gold as a precious metal. The second one is FBT US Equity, which replicates the return of the Arca Biotechnology Index of NYSE (New York Stock Exchange). The third one is IAH US Equity that allows the investor to be exposed to different internet architecture companies such as Apple, Dell, Cisco and IBM. Finally, the fourth ETF is BHH US Equity, formed by two companies engaged in the internet business between companies. The following rations were obtained after the optimization processes of each one of these four assets:

Graph 2

The portfolio obtained based on the ETFs mentioned have an average monthly return of 1.47% and a monthly risk of only 4.1%.

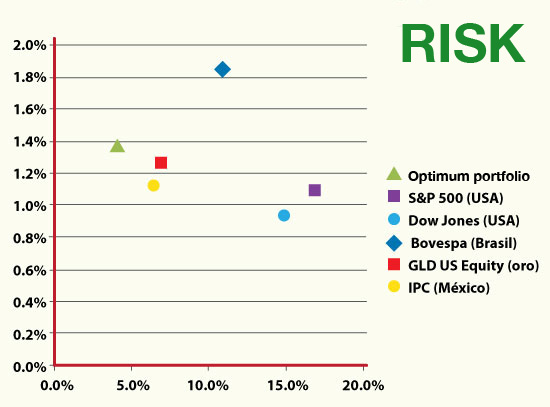

In Graph 3 a comparison is made between the portfolio risk and its return, versus the indices of countries that normally use this as a reference of a well diversified portfolio. As a comparison, portfolios were used that replicate the S&P 500 (A U.S. stock index normally used by portfolio managers to compare their investments with a benchmark), Dow Jones Industrial (stock Exchange index of the United States), Bovespa (Brazil’s stock Exchange index), IPC (Mexico’s stock Exchange index) and finally GLD, which replicates the evolution of the price of gold, one of the precious metals that has proven a significant return in recent years and that has received a great deal of attention in specialized media. In its vertical axis the graph shows the average monthly returns of the different portfolios and in the horizontal axis its risk measured as the portfolio’s monthly average variation. The only portfolio with more return than the optimum portfolio example is Bovespa; however, the risk assumed when buying this portfolio is more than twice that of the optimum portfolio. All the other portfolios show a smaller return and higher risk. It calls our attention that in a 500 stock portfolio such as the S&P 500 there is higher risk and lower returns than one of only 4 ETFs like the one proposed. It is also noteworthy to see that many of the industry portfolio consultants and managers compare the returns obtained in their portfolios against the returns of indices that are clearly not optimized, such as could be the S&P 500 or the Dow Jones Industrial.

Graph 3

The problem of portfolios that replicate countries’ indices is that they do not diversify globally. For example, you can buy an ETF called iShares MSCI Emerging Index Fund (ticker:EEM) that replicates the return of a portfolio (weighted by the capitalization value) of countries of emerging markets (China, India, Brazil, Mexico, etc.). This ETF is going to be less sensitive to changes in the domestic policies, compared to the sensitivity of a portfolio that for example, replicates the return of one of those countries.

Definitively, the new advances and progress in financial issues allow us to obtain portfolios, at a low cost, with a degree of diversification that previously could only be created by paying exorbitant commissions. A good long term investment strategy is to buy a globally well diversified portfolio, and this can be achieved by using a couple of ETF and at a very low cost. Historical data shows that an investment of this kind is profitable and hardly beaten by traditional portfolio investments, even by finance professionals. In recent years diversification has become significantly simplified and it is within reach of all investors, regardless of their degree of sophistication. This article proves that even popular sayings are obsolete in view of the advances achieved by new technologies. In order to have a good diversification it is not longer enough to place the eggs in a different basket, one also has to make sure that they come from different hens.?

One Trackback

[...] EstratégicaCarrusel « Diversificación: Un Nuevo Enfoque ¿Conviene Respetar a los Consumidores? » Versión para imprimir 0 Comentarios [...]