By: Cuauhtémoc Altamirano, Federico Hernández and Hugo García

KPMG Cárdenas Dosal, S.C.

Capital Development Securities, (CKDs as are known in Mexico) are a type of trust security designed to finance long-term public works, infrastructure, realty and technological projects. Such is their potential that it is hoped they will help reactivate the Mexican economy and enable pension funds to offer savers more for their money.

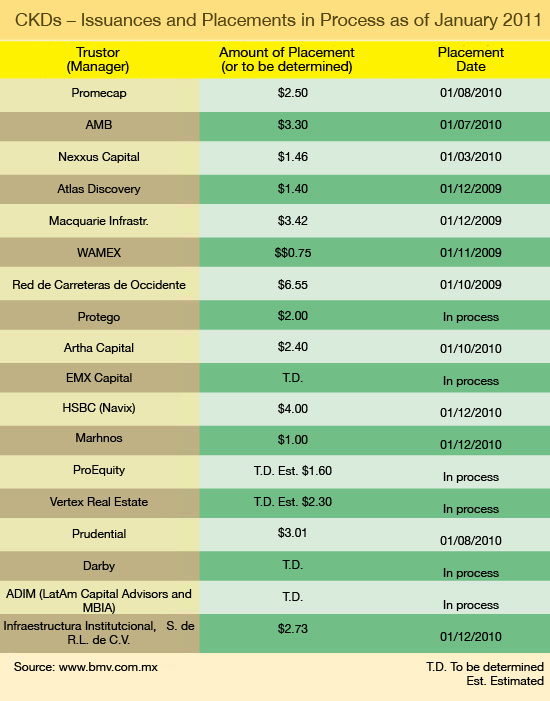

Although they are the “new kid on the block”, CKDs are already shaping up as an interesting alternative for the financing of large infrastructure, realty and commercial projects in Mexico. To date, the Mexican Stock Exchange (BMV) has seen more than 12 CDK placements for over 30 billion pesos and there are more in the pipeline. The main challenge will be to spark the interest of accredited investors, namely Specialized Retirement Investment Funds (SIEFORE) and their corresponding Administrators (AFORE), which have an estimated 1.4 billion pesos available for investment in these instruments.

CKDs are negotiable securities issued by a trust, to which a company transfers assets that generate variable returns. An excellent opportunity for institutional investors, Mexico is just one of the countries that has embraced this new investment mechanism, along with Australia and Canada, where they are known as Income Trusts. But it wasn’t until 2009 that this was possible, when reforms were introduced making it legal for Mexico’s SIEFORE to invest in private enterprises and projects. CKDs are designed to finance medium to large projects over the long-term and, as such, are attractive to companies and projects that require long-term investment, as well as institutional investors on the hunt for risk-controlled opportunities that offer competitive returns. The SIEFORE fall into this category, and, to a lesser extent, insurance and bonding companies, which can also purchase CKDs, as well as investment companies, private pension funds and accredited individual investors.

Unlike common stock, CKDs have a term, generally ten, 20 or 30 years, or as stipulated in the placement prospectus, while stocks represent a company’s equity indefinitely or until such time as the company is wound up. In both cases, investors are equity partners, but under the CKD model, they intervene as trustees and sit on management and audit committees. Once the term expires, the trust management must dispose of the assets and divide the proceeds among investors.

CKDs are also different to debt securities. In a conventional bond placement, the issuer agrees to pay a known and previously negotiated rate of interest, whereas CKDs do not secure liabilities, but represent part of the company’s equity and assets – maybe an airport or a highway concession. In this respect, they are more akin to common stock. As equity partners, investors are entitled to a percentage of profits and may participate in the organization’s governing bodies. In the case of CKDs, profits are linked to the business’ success, i.e. investors will only see a return if sales are good or if the assets the company owns or acquires appreciate. They may even make money on the sale of other, non-priority assets.

Long-term Investments

Are there long-term investments that offer competitive returns for both SIEFORE and other institutional investors? Although they are relatively new, CKDs could well be the solution to the complex dilemma of how to finance medium- and long-term projects at an acceptable risk level and still hope to earn attractive returns for, say, the thousands of savers affiliated to one of the country’s pension fund administrators.

In the short time they have been around, CKDs have sparked considerable interest on the market and among investors, including financial institutions and experts with the necessary experience to trade in them. To date, the Australian bank Macquarie, the Mexican construction company ICA in partnership with Goldman Sachs Infrastructure, the Nexxus, WAMEX and Atlas Discovery funds, Prudential Real Estate Investors, Promecap and HSBC-Navix have all made CKD placements with a view to securing financing.

As mentioned previously, CKDs are basically designed to finance infrastructure, yet they can also help finance property developments, technological, private equity and mining projects.

Prospectuses and ticker symbols for each placement are published on the website of the Mexican Stock Exchange (www.bmv.com) along with information on their purpose, term and type of management.

CKD Placements in Mexico

Since 2009, the year in which legal conditions for the issuing of CKDs were created, 12 placements have been made, the proceeds of which have been used to finance infrastructure, equity capital and property development projects and, to a lesser degree, financial entities. The most talked-about of these was the placement made by Red de Carreteras de Occidente (RCO), a subsidiary of ICA, in which Goldman Sachs Infrastructure participated as a financial partner. The issue raised 6.55 billion pesos (which was used to refinance short-term liabilities). Placements have also been made by the Australian bank Macquarie (3.4 billion pesos), HSBC-Navix (4 billion pesos) and AMB (3.3 billion pesos), while participating Afores included Banamex, Coppel, HSBC, Inbursa, ING, Invercap, Metlife, PensionISSSTE and Profuturo.

Opportunities for Issuers and Investors

Given that CKDs target large investors, it should come as no surprise they haven’t garnered much media attention. Yet we are dealing with a novel investment tool that could turn out to be instrumental in promoting development in many sectors of the Mexican economy.

There can be no denying the lack of long-term investment options in Mexico. These presently include Treasury Certificates (CETES) and ten-year Pemex bonds, which have minimum or very low risk attached, but pay out modest interest. This is hardly motivational for the institutional investor segment, particularly SIEFORE, which demand returns on a par with the expectations of the country’s future retirees and which, pursuant to the Retirement Savings System Law, may invest only a portion of their assets in higher-risk, variable income bonds.

By the same token, restrictions on long-term financing affect organizations engaged in large-scale projects that take time to mature and that won’t generate profits for several years. This is precisely where CKDs come in. Designed to finance long-term projects with the help of well-identified investors whose resources and investment needs coincide with their unique features, CKDs are emerging as a great investment opportunity, as the Afores that have already invested in placements on the Mexican Stock Exchange can attest to.

AFORE as Future CKD Investors

Although Mexico’s AFORE manage a substantial amount of assets, they are no match for the value of those handled by pension funds in similar countries. Likewise, contrary to trends in other countries, in Mexico the financing provided by pension funds like the AFORE is relatively low compared to bank financing. However, in the medium term, AFORE financing is expected to exceed financing extended by Mexican banks. We believe that, while AFORE currently invest mainly in government securities, with CKDs accounting for no more than 3% of their total investments, the strong growth projected for pension funds will come hand-in-hand with increased investment in this new financial phenomenon.

CKDs have the potential to balance out companies’ financial needs (including a long-term perspective) and the interests of large institutional investors, namely AFORE, which need to invest their assets to the benefit of the workers who contribute to them.

Boasting features that set them apart from ordinary shares, debt securities and other investment instruments, CKDs have awakened market interest, as evidenced by the fact that the first five placements in Mexico raised a total of 16 billion pesos in 2009. By 2010, this figure had surpassed 17 billion, with another 10 placements in process in 2011.

As this instrument gains popularity, it is vital we understand the associated risks and challenges and establish regulations and guidelines to protect both investors and issuers.?

Table 1: CKDs, Issuances and Prospective Placements

One Trackback

[...] EstratégicaCarrusel « CKDs: Novedosa y Prometedora Fuente de Fondeo Versión para imprimir 0 Comentarios [...]