By: Sylvia Meljem

By: Sylvia Meljem

ITAM

This article briefly analyzes the major trends in business today and their repercussions on the information value chain industry, which encompasses most of the activities carried out by accountants.

The Forces that are transforming the world

According to a 2010 study by Ernst & Young, the results of which were published in a paper called Business Redefined, the forces transforming the world today are vast, complex, challenging, and are moving with an unprecedented speed and intensity.

Renowned futurologist Dr. Ian Pearson says that in 2020, the business world will be defined by the following features:

- We will begin to move toward an economy of environmental care.

- There will be more face-to-face interaction.

- People will look increasingly to online resources for organizing their activities.

- Social responsibility will be a key factor in survival.

- The key qualities for a company’s survival will be versatility and adaptability.

- People with solid skills, knowledge, and excellent contacts, will be among those that benefit the most in the economy of the future.

- Miniaturization will continue in voice recognition and fingerprint tracking devices, in interfaces, and in mobile phones.

- Artificial intelligence will steadily improve productivity.

- The Semantic Web will allow users to automate a large percentage of administrative activities, making it less necessary to outsource some services.

- New forms of marketing and distribution will emerge that include the use of wireless memory devices.

- Increasing automation will change the focus of information toward interpersonal work.

- A toward humanization of work and society.

- A general shift in industries toward providing a more local response in manufacturing, financing, and services.

- One of the major effects of E-trade will be a global standardization of tools and procedures used by companies.

- The widespread use of social media will create an almost perfect network for transmitting ideas from the people who generate them, to others who can put them into practice; those who are capable of applying them will reap greater rewards than those who conceive of them.

- The winning companies will be logistics firms and those that can supply resources and financing.

- Greater alliances will be required between small companies and major consortiums, and specialists will have to be hired, given the large number of local and international abilities that will be necessary to operate a business.

Taking into account all these characteristics and with the results of interviews of academic and business leaders, the Ernst & Young study concludes that the six trends that can be expected to have the greatest impact on redefining business will be the following:

- The increasing political and economic dominance of emerging markets (mainly by BRIC countries) will cause global companies to rethink and customize their corporate strategies.

- Climate change will remain high on the agenda as companies seek to explore resource efficiency to improve the bottom line and drive competitive advantage.

- The financial landscape will look vastly different as increasing regulation and government intervention drive restructuring and new business models.

- Governments will play an increasingly prominent role in the private sector as demand for greater regulation and increasing fiscal pressures dominate the agenda.

- In its next evolution, technology will be driven by emerging-market innovations and a focus on instant communication anytime, anywhere.

- Leaders will need to address the needs and aspirations of an increasingly diverse 21st century workforce.

How these changes have affected and will affect the accounting profession

The following briefly sums up most important events of recent years, as well as their consequences, divided into three phases:

I. Redefining the profession

II. Financial crisis and scandals

III. The path toward international regulation and convergence

I. User demands, the information value chain and the challenges of the accounting profession, according to studies carried out in 1995

Already in 1995, leading global accounting firms were becoming concerned over the lack of relevance of the financial information generated in financial statements. Specialist Robert Elliott prepared a study investigating the leading opportunities and threats facing the profession at that time, what user demands were, and what type of profile would be needed to provide them the appropriate services.

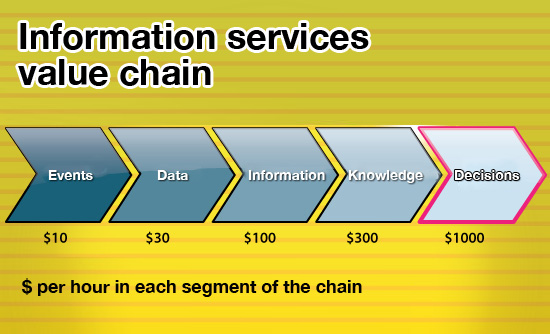

The first question he asked was what the information value chain is, and what role the accountant plays in it. As Figure 1 shows, the answer is that we have a wide range of activities in the chain, which go from recording the transactions companies perform to transforming information into value-added knowledge that help users to make the right decisions. These activities are carried out as much by technicians (recordkeeping) as by specialists (professionals), which have very different levels of preparation and compensation (see figure).

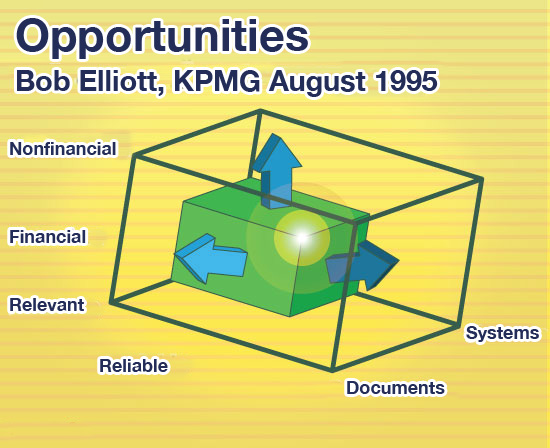

The second question was what opportunities are there for the profession in light of user demands. The answer was that accounting must move away from the traditional idea of generating reliable financial information in the form of a document (financial statement package) and move toward one that is more adaptable to user needs, involving the generation of pertinent financial and non-financial information in a variety of formats, taking advantage of the databases with which companies operate (Figure 2).

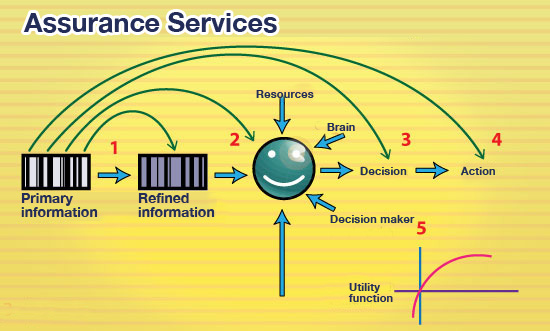

Finally, the study asks what is the role of the profession, and what an accountant should do to meet these demands. The response at the time was that accountants needed to begin providing “assurance services” in order to give users relevant financial and non-financial information they could use to make the right decisions (Figure 3)

II. Financial crisis and scandals and their repercussions in the accounting profession

In the years following this redefinition of the role of the public accountant, a series of financial crises and scandals broke out, once again calling into question the accountant’s main job, now no longer as a supplier of relevant information for decision-making, but as a professional responsible for establishing controls and informing of business risks.

The World Bank has carried out several studies and found that financial crises are caused primarily by incomplete regulation, ineffective supervision, and the lack of information.

According to the World Bank, it is urgent that countries learn how to avoid these crises, because they cause panic reactions, abruptly halt economic activity and foster deepening poverty.

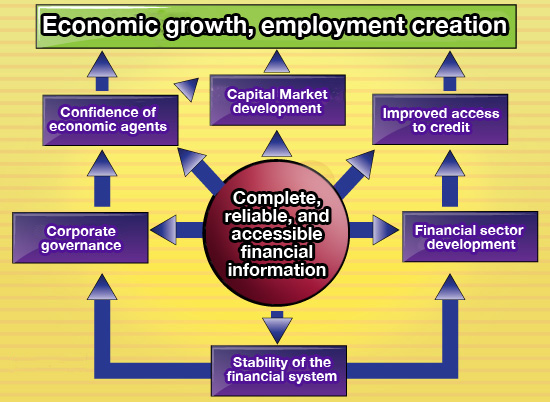

The strategy of international organizations should therefore be to encourage the generation of reliable, complete and accessible financial information (Figure 4), for the ultimate purpose of increasing economic growth and creating jobs.

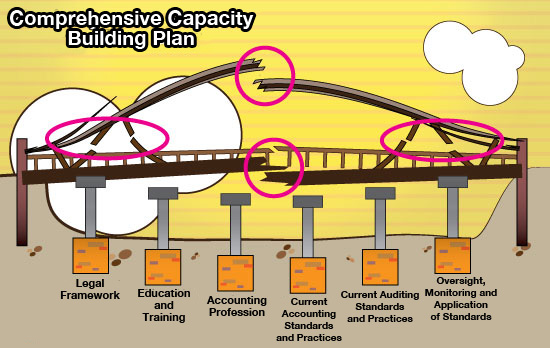

At the initiative of the World Bank, other international organizations joined in, among them the International Federation of Accountants (IFAC), which headed up a program to strengthen the accounting profession throughout the world. IFAC pointed out various problems that must be resolved, particularly in emerging countries (figure 5):

- Obsolete legal framework

- Weak accounting profession

- Failure to comply with standards

- Weak monitoring mechanisms

- Lack of access to international standards

- Inadequate programs and training

- Lack of availability of guides and practical manuals

III. The Path toward international convergence

Since that time, a number of significant changes have taken place, the most important of which have been:

- United States: Sarbanes-Oxley Law (2002)

- Europe: Eighth Directive (2006)

- International Accounting Standards Board (IASB)

- Convergence with United States

- Project for small and midsize business standards

- New conceptual framework

- Alliance with IFAC to establish international standards

- Public Interest Oversight Board (PIOB, 2004)

- Compliance Monitoring Program (2004)

- “Clarity” Project

- Rapid convergence toward International Financial Information Standards and International Auditing Standards (IFIS and IAS)

- Growing number of countries have adopted IFIS (Mexico in 2012)

- Banking industry: Brazil (2010), Chile

- Public sector

- Independent control of professional practice

- PCAOB in the United States

- Various programs in Europe and other countries

- First attempt in Latin America: Colombia, El Salvador

- Efforts to reduce the cost of operating a business in each country: competitiveness

- Automation of bookkeeping (XBRL)

- Greater cooperation between countries

- Regulatory institutions

- Standards issuing institutions

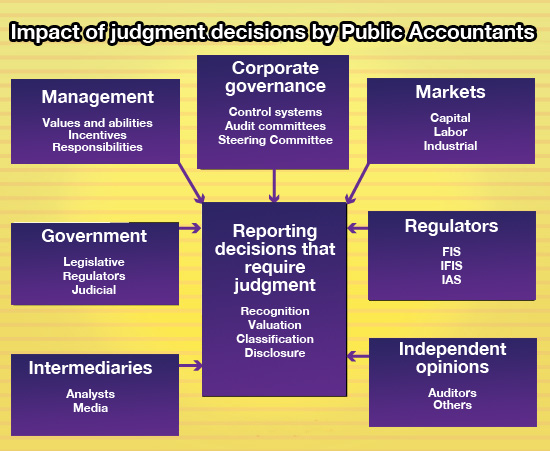

All of these changes have dramatically transformed the exercise in the accounting profession, primarily as regards the exercise of professional judgment and the impact it has on the series of players that use the information generated (Figure 6).

There has been a growing international effort to bring about this convergence, and an increasing awareness of the importance of protecting the public interest. The IFAC has said that “public interest” is the common benefit that all citizens receive from the services provided by the accounting profession. The “public” should include all individuals and groups in society, since the activities of the accounting profession affect each consumer, supplier, and taxpayer that receives a service.

The responsibilities of the accounting profession are conceived of in a way that protects certain public “interests”, which include:

- The solidity of financial information

- The capacity to make international comparisons of financial information

- Fiscal prudence in public spending

- The contributions that accountants make to companies’ corporate governance and their organizational performance

For this reason, many participants have an interest in strengthening the accounting profession in the world, because they are aware that reliable, transparent and accessible financial information on a global scale is indispensable for meeting the following goals:

- Improving the economic climate and making it attractive to investors

- Creating conditions that are good for company growth, facilitating access to credit

- Promoting the development of pension funds

- Facilitating integration

- Facilitating oversight by fiscal authorities

- Helping credit institutions to function better

- Assist the government in supervising and overseeing the activity of public service companies

In coming years, international efforts will continue in the following areas:

- Convergence toward IFIS

- Training and ongoing education for professionals

- Strict standards for obtaining and renewing a professional license

- Qualified supervisory agencies, with the resources and authority needed to enforce application of standards and sanction those who fail to meet themP

- rofessional institutions with the wherewithal to participate actively in the process

A report from the McKinsey Quarterly highlights five key trends in accountants’ work, and to some extent they converge with the mega-trends that are redefining business, listed at the start of this article:

1. An increase in the audience for and type of reports, and in social responsibility. More emphasis will be placed on the “social license to operate” (certification) and the need to reevaluate the expectations of stakeholders, like clients, employees, communities, and capital markets. This will mean a larger public for accounts to communicate with, and an increasing diversification in the way they communicate.

2. An increase in the regulatory and compliance aspects of accounting. Many aspects of accounting, particularly financial accounting, will become regulatory in nature. As a business goes beyond compliance, it must develop guidelines that reflect the dynamic and complex nature of its administrative and commercial practices, particularly the management of risk and ethical conduct.

3. Greater synergy between internal and external reporting. The way in which companies are analyzed is changing, particularly in the limits of the analysis, because companies place a high priority on their relationship with supply chains and clients. Clarity about the focus and scope of financial reports will help to narrow the gap between internal performance and what is disclosed to the public. Accounting information systems are used both to record transactions and to make decisions.

4. Fundamental role in an organization’s corporate governance. Accountants not only supply financial information and recommendations to the Board of Directors, but also serve as a vital component of corporate governance, helping to maintain a climate of transparency and ethical conduct. Accountants will play a key role in the development and application of regulatory frameworks that have emerged to guide organizations’ corporate governance.

5. Reports on the social and environmental impact of organizations. The term “sustainability” has begun to be used by organizations to refer to the long-term permanence of the business. Sustainability is a term that touches on various facets of the business and its relationship with the world around it.

Accountants are very good at measuring everything that can be quantified and monetized. Social and environmental transformations can provide crucial information on the future course of business with ambitious plans for economic sustainability. The challenge for accountants will be to help develop knowledge on creating and expressing metrics that relate an economic entity’s creation of economic value with its environmental and social sensitivity.

Like recent advances in the measurement, registry and disclosure of carbon use and trading in carbon certificates by companies and governments, accounting will need to take the new trends into account in order to formulate information on the business’s economic results together with its impact on biodiversity and ecosystems.

Having reviewed the recent changes the accounting profession has faced, and those that lie in store for the future, the reader cannot help but agree with the title: we are in the eye of the hurricane. There are daunting challenges ahead, but also opportunities to protect the public interest, and this will preserve the essential relevance of our profession.?

References

- World Bank. Report on Observance of Standard and Codes (ROSC) in emerging countries.

- CIMA (2010a). Accountants in the next decade. World Conference of Accountants, Kuala Lumpur.

- CIMA (2010b). Accounting trends in a borderless world. World Conference of Accountants, Kuala Lumpur.

- Elliot, Robert (1995). The Future of Assurance Services: Implications for Academia. Accounting Horizons, (9); 4: 118-127.

- Ernst & Young (2010). Business redefined: A look at the global trends that are changing the world of business.

- Holtzman, Y. (2004). The transformation of the accounting profession in the United States. Journal of Management Development, (23); 0: 949-961.

- IFAC Policy Position Paper 4 (2010). A Public Interest Framework for the Accountancy Profession.

One Comment

Estudios prospectivos como ese de E&Y valen la pena ser tomados en cuenta por los trabajadores que están vinculados a la innovación, de hecho todos deberíamos estarlo. Posiblemente de este tipo de fuentes haya sido de donde Michael Porter obtuvo la idea de modificar la Responsabilidad Social Empresarial hacia el concepto de Valor Social Empresarial (HBR enero 2011) de manera que las empresas nos preocupemos por vincular el éxito de la empresa con la dignidad de los trabajadores, su bienestar y que las externalidades de los resultados empresariales se transminen a propósito, bajando hacia la comunidad.