By: M.C. Norma Leal

By: M.C. Norma Leal

In the article “A 20 años del ABC” (“20 Years After ABC”), published in Dirección Estratégica [1] we presented the advantages and disadvantages of an activity-based costing system (ABC). The ABC system can calculate unit costs more accurately than a traditional costing system, and it also improves the processes because the activities to carry them out can be better understood. We also stated that more than 20 years after ABC was developed in its current form, studies from different countries show low adoption rates and that a large number of companies that adopted the system had already abandoned it.

Subsequently, in a second article, “Is my costing system obsolete? [2], we saw the reasons why the companies change to an ABC costing system and the symptoms of a costing system when it becomes obsolete. The obsolescent systems warn companies of potential distortions of their production unit costs calculated with a costing system based on volumes.

The most common problem is “crossed subsidies” amongst the company products. In addition to the analysis of these symptoms we mentioned that the company must examine the changes that have occurred in its manufacturing environment and its surroundings, before deciding if it is time to update or redesign the cost system. The main changes that affect the system are the following: increased automation of the productive processes, introduction of new products, changes in the marketing strategy, simplification of the productive process, increased competition and deregulation.

Some interesting questions for a company that is considering the possibility of changing to an ABC costing system are: Which is the optimum costing system for the company? What potential benefits does the adoption of and ABC system offer? Are the unit production costs more accurate if calculated with ABC? Under what conditions are the ABC systems preferable? What is the relationship between the use of ABC and the financial and operational performance of the company? This article will answer these questions.

Which is the optimum costing system for the company?

The decision to change the company’s costing system, as in all other investment projects, should include a cost-benefit analysis in which you can compare the costs of designing and operating the new system with the benefits it will provide. In addition, companies should consider the potential risk it is exposed to if it decides not to change their costing system.

In making this decision, one should consider that there is a costing system that not necessarily should measure all the costs in an extremely accurate way. Measuring every little piece of material and every second of the worker’s labor can be costly and take a long time. This investment in money and time would only be justified if there were serious consequences to providing inaccurate information.

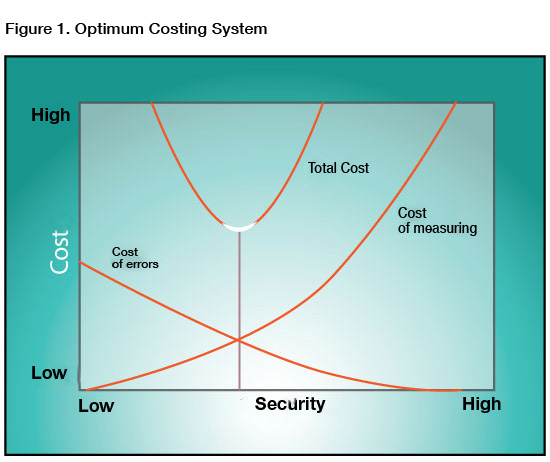

In this regard, in 1984 Cooper [3] stated that there are two costs in the design of the entire costing system: 1) the cost of errors, and 2) the cost of measuring. The cost of errors is the result of wrong decisions made with the information provided by the costing system. Hence, the more accurate the costing system, the lower the cost of errors; with a less accurate system, the higher the cost of errors. The cost of measuring depends upon the information processing technology. The more accuracy you demand from the costing system, the higher the measuring cost; the lower demand of accuracy from the system, the lower the cost of measuring. The optimum costing system for a company shall be the one that minimizes the total cost resulting from adding the cost of errors to the cost of measuring, as can be seen in Figure 1.

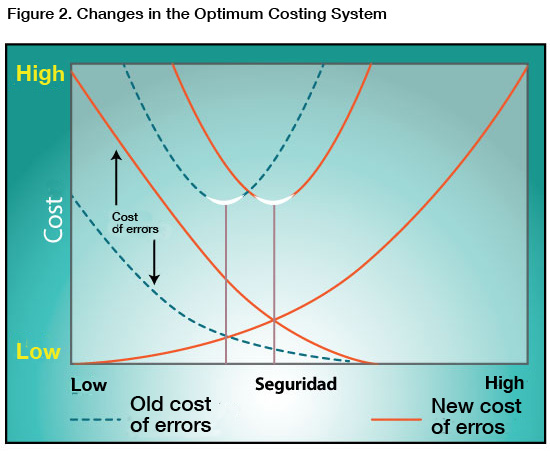

It is important to highlight that the optimum costing system is not static; it is rather a target in movement. Innovation in information technologies constantly reduces the measuring cost of the costing system. Likewise, the ever growing competition increases each time more the cost of errors so much so that the company could even be driven out of the market if wrong decisions are made based on erroneous information. Therefore, the current trend is that both curves move to the right and at the same time and displace the total cost curve also to the right. A concrete example of this is the case of a regulated product whose price is set by the government, but that at a given point in time it is deregulated. With this, the competitive options of the company increase and it could happen that its costing system that worked fine until that date is no longer good because it drastically increases the cost of its errors. This moves the errors cost curves and the total cost to the right, as shown in Figure 2.

However, in the cost-benefit analysis of the decision to implement or not implement an ABC system, the Company is facing reality, namely that the costs of implementing ABC are tangible, because they include immediate investment of management time, money and commitment; and these are scarce resources. In contrast, the potential benefits its implementation promises are intangible, because they do not generate the visible reduction of inventories and of the production cycle that happens with a just in time system, (JIT), aside from the fact that it is difficult to assign the benefits of making better decisions to the implementation efforts of ABC. This is a complicated situation if the companies have not clearly defined what they expect from an information-based administration as provided by ABC and to what degree management is committed to the implementation strategy [5].

What are the potential benefits offered by adopting ABC?

For Cooper and Kaplan [8], there are various potential benefits of ABC and they can be grouped as follows: 1) strategic potential benefits, by providing more accurate unit costs of the products, which are better information to make decisions such as how to buy or produce, determine the product mix, eliminate or not a production line, analyze competition, inject resources to the most profitable line, etc., and 2) potential operational benefits, obtained from better understanding the production activities and the drivers that explain their cost and that we can summarize in lower costs, quality improvement and reductions in the production cycle time.

Lower costs. By providing detailed information on which activities add value and which do not, and on the costs of those activities and their drivers, ABC allows: a) to design products and processes that require fewer activities and, consequently fewer resources, b) increase the efficiency of the current activities and determine those that do not add value to the customers, and c) improve coordination between customers and suppliers.

Improve quality. The information of activities and drivers provided by ABC help identify the low quality activities and the persons causing those problems, apart from revealing the costs of the activities related to quality that do not add value. In addition, this information may help do an optimum distribution of resources to improvement projects.

Reduction of the cycle production time. Upon identifying the ABC activities that do not add value but increase the life of a process (review, count, move, adjust the machine before a production run, etc.), would help reduce the process time and it would also provide the necessary detailed information that is required to minimize the delays.

Are the production unit costs calculated with ABC more accurate?

Several articles document cases of successful implementation of ABC in companies. Whirlpool is one of those cases and it was studied by Beier and Mehmet [9]. The company made a pilot Project with ABC in all the production lines of its Evansville plant. As an interesting piece of information, ABC assigned to low volume Whirlpool products two or three times more indirect expenses than were assigned by the traditional costing system. The extreme example is one product to which a 64.48 dollar indirect expense was allocated with the traditional system while with ABC 25,447.11 was allocated. One of the reasons for the success of the project was the low cost incurred in its implementation, because almost all the information they needed for the system was already available in the company’s financial accounting system. In contrast, other analytical studies say that all the cost information provided by an ABC system is not necessarily more accurate than the one provided by traditional unit based systems. Data et Gupta (1994) show in a study [6] that precising the specification of the basis to distribute costs and increase the number of cost groups in the ABC systems may increase the errors of measuring the product cost. Other studies add that the desire and capability of an ABC system to produce relatively reliable costs varies with competition in the markets and technologies used by the organization, and conclude that the ABC systems are preferable only under specific conditions [4].

Under what conditions are the ABC systems preferable?

Many ABC proponents argue that the use and adoption of the system is an endogenous election in which the benefits vary depending upon the operation characteristics of the plant [4]. For example, Cooper and Kaplan show that the economic benefits of ABC increase if the company has more product lines and a wider variety of products. Other accounting circles state that the effects of ABC vary with the production process used at the plant. Reeve states that the plants with continuous processes have not adopted ABC because many of the cost drivers managed in these systems, such as the activities related to changes of products, are less important in those operations [5]. On the other hand, Krumwiede, states that it is less likely that ABC systems are implemented in production plants that use job order cost, because the uncertainty of this kind of production makes it difficult to manage such a system. For other authors, such as Kaplan and Cooper, the ABC would be more beneficial combined with advanced production practices such as JIT, total quality management and information technologies [4].

What is the relationship between the use of ABC and the financial and operational performance of the company?

For some authors, the success of ABC lies almost exclusively in the perceptual performance measures. Foster & Swenson [7] group these success measure in four categories: 1) the use of the ABC information, 2) decisions and actions taken with ABC information, 3) evaluation of the management of ABC’s total success, and 4) financial improvements perceived from the implementation of ABC. In general, in these studies we can see the scarce use of information from ABC and moderate benefits as of the starting up of the system [4]. However, few of these studies try to prove that the perceptual measures are correlated significantly with the financial and operational measure, aside from the fact that the studies have been made in small samples [4]. Aware of the limitations herein above, Ittner, Lanen and Larcker [4] made a study with a 2789 sample of companies and examined the association between the extensive use of cost-based activities and they examined the association between the extensive use of costing based on activities and the financial and operational performance of the plants. The study highlights the following conclusions: 1) on average, the extensive use of ABC is associated to higher quality levels and a higher reduction in the production cycle time; 2) the use of ABC does not maintain a direct relationship with the production costs, but it can have a significant indirect positive association with production cost reductions by improving quality and the production cycle time; and 3) the association between the net financial benefits, measured by the return on assets, and the use of ABC, varies with the operational characteristics of the plant. On average, the use of ABC does not have an association with ROA. It should be mentioned that a limitation in the Ittner, Lanen and Larcker study is to assume that ABC is equally applicable in all the plants..

As can be concluded from the previous research, the decision to implement an ABC system is not a simple one nor does it offer guaranteed results. Therefore, although some companies have been successful in establishing this system, others are still wondering if ABC is not an exercise that not only does not add value but rather distracts the organization from its activities of identifying and giving value to their clients..?

Bibliography

1. Huerta E. y Leal N., A 20 años del Costeo basado en Actividades, Dirección Estratégica, No. 17, March -May 2006.

2. Huerta E. y Leal N. ¿Está Obsoleto mi Sistema de Costos?, Dirección Estratégica, No. 18, June-August 2006.

3. Cooper, R., You need a new cost system when… Harvard Business Review, 1989, 66(1): p. 77-82.

4. Ittner, C.D., W.N. Lanen y D.F. Larcker, The Association Between Activity-Based Costing and Manufacturing Performance. Journal of Accounting Research, 2002, 40(3): 711-725

5.Reeve, James R., Projects, Models, and Systems-Where Is ABM Headed?. Journal of Cost Management (summer, 1996), 10 (2): 5-16

6. Datar, S.M. y M. Gupta., Aggregation, Specification and Measurement Errors in Product Costing. The Accounting Review (October de 1994): 567-91

7. Foster, G., y D. Swenson, Measuring the Success of Activity-Based Cost Management and Its Determinants. Journal of Management Accounting Research (autumn de 1997): 109-141

8. Cooper, R. y S. Kaplan , The Design of Cost Management Systems. Prentice Hall, chapter 5, 1991.

9. Cynthia, B. and Kocakulah Mehmet, Implementing and ABC Pilot at Whirlpool, Journal of Cost Management (March-April, 1997): 16-21.

One Comment

Hello there, You may have carried out a wonderful job. I most certainly will absolutely reddit the item and for me personally propose to my buddies. I am certain they’re going to be benefited from this web site.