Corporate Social Business Value

Posted By Ceci On 12 December, 2011 @ 8:20 am In Edition 39,Marketing,Human Resources | 1 Comment

By: Carlos Amtmann

By: Carlos Amtmann

“Therefore every scribe which is instructed unto the kingdom of heaven is like unto a man that is an householder, which brings forth out of his treasure things new and old”

Matthew 13, 52

I. Background

When Mexico legislated labor conditions in the Mexican Constitution of 1857, the nation introduced the right to freely choose a trade or profession, the obligation to remunerate, banned child work at an early age and stated a commitment “to pass laws improving working conditions and rewarding those who excel in science and arts”.

Years later, the law incorporates ideas from abroad. Article 123 of 1917 Constitution regulates working relations and thus incorporated those European social principles from the 19th century: working hour limits, banning child labor, establishing mandatory holidays, maternity leave, minimum wages, and the right to form unions, among others.

The Mexican Institute for Social Security (IMSS) was created in 1948 as a federal replica of those health and retirement services established by some entrepreneurs from Monterrey. It encompasses health services, maternity leave, and retirement. Employers contribute with 7.7% of salary while employees contribute with 1.3%. Unfortunately, IMSS administrators did not provide for proper pension reserves, causing a deficit which triggered a change in the pension system during 1997. Now the system is based on individual accounts, administered by private institutions (AFORE) where out of the 6.5% salary contribution is paid by the employer (5.15%), the employee (1.15%), and the remaining covered by the federal government in a 24-year-labor term.

While that established a cap on the IMSS liability, funds projections are still not encouraging. At some point additional money will need to be added to the system.

Another pressing problem, however, is that the working population in Mexico delists frequently by changing into informal jobs. The actuarial projection is that a young man beginning a working career today will be part of the social security systems for only 12 years during his projected labor life. That number falls to 9 years for a woman. Currently, 42% of the economically active population contribute (18.3 million out of 44) to the IMSS, excluding the 16.2 million Mexicans who live abroad. Mexico would need an average real GDP growth rate of 4.75% for 30 years to bring 80% of the working population into the social security system.

Current labor law (from 1970) introduces the housing issue. This law has interesting consequences. A fund is created with employers contributions equal to 5% of workers’ salaries. It is administered by the Institute for Workers Housing (INFONAVIT). It´s board is made up of by representatives from the government, unions and employers. It covers both construction and financing.

In the beginning it had a poor performance, especially at the mercy of authoritarian and financially undisciplined governments. Major construction projects and preferential treatment in the assignment of apartments were awarded by bribery. But in recent years it has received awards for its systematization. More transparency avoids bribes and has kept the construction industry in black numbers, raising its productivity. Since inception it has financed 6.1 million dwellings, representing 24.7% of Mexican households.

Last year corporate social value added by this system has gone one step beyond. INFONAVIT and the Mexican Institute for Competiveness have ranked cities and their urban development areas by means of indicators ranking them by both, quality of life and an increase in home value that housing projects may obtain. The best ranked are granted lower interest rates for construction purposes and for financing the house purchase by credited workers.

The current labor law protects workers from unjustified layoffs. In such a situation, the employer must pay compensation equal to three months salary plus 20 days for each year employed. Plus an extra 12 days per year employed, with day´s pay value capped at the equivalent of twice daily minimum wage. All these originate liabilities for employers starting at the moment of hire.

The 1970′s law also included a profit-gain distribution clause (10%). This benefit is in no way related to individual productivity, for it has been designed half in accordance with salaries level proportion and hay by days labored. Nevertheless, only 30% of companies actually pay it. One way to bypass it is by hiring the employees under a different company, hereby eluding the issue of certain labor related liabilities and in occasion lowering contributions to IMSS.

II. Benefits and Challenges Posed by Stability

After a substantial effort, Mexico’s Central Bank became an independent entity, inflation rates dropped, democratic governments improved transparency, reduced red tape, and lowered public deficit. The result has been an increase in currency reserves, inflation control, an increase in industrial productivity and construction, as well as an increase in purchasing power, albeit minimum wages are still lagging.

Nevertheless, Mexico is a developing country evolving from an efficiency driven economy in transition to an innovation driven stage of development. Gini’s index dropped from 53% to 49.3%, ranking Mexico from place 107 to place 100 out of 135 countries. Its GDP per capita is too low for the 13th biggest economy in the world. Of OECD countries, it ranks last in working mobility and ranks 115 in use of talent. Although an ancillary benefit of such low mobility is the reduction in the unemployment rate to a level of 1.8% since the 2008 downturn, compared to 2.1% from that of OECD countries average.

But there is hope. Wages schemes have been modified. We have opened markets with innovative remuneration schemes that establish Worker Productivity Funds based on dividends from the employees’ life insurance policies. These funds, a complement to those from AFORE´s, are delivered when workers leave and are a cushion to the aforementioned labor liability.

III. From Good to Even Better

We anticipate changes in labor law requiring productivity plan registration by which workers are compensated in this area. To this goal, it is advisable that companies set strategic goals, orienting those goals to those of the workers’ at an individual or group level, or even better, combining them at the level of business logical processes.

After evaluating worker performance, employees would receive a bonus according to the respective score and amounts allocated by the company, usually 20% of quarterly salaries. As stated the law considers the profit-gain distribution, but beneficiaries are limited, since it is common practice that the employer is a separate entity. In consequence, it is preferable that reforms in labor law establish the obligation of measuring a productivity index and the obligation to settle a percentage of after tax gains as a basis for productivity bonuses and then, distribute them according to an evaluation of individual performance. With this, compensation is settled in terms of productivity and innovation of the whole workers unit. From that amount the unit opens a wider possibility, that of contributing individually in a percentage of the productivity pay to a fund payable in case of leave or in that case, for an economic need during recession times, loan compensation or even as a one-time contribution to AFORE´s.

Such measures have been adopted by medium-sized companies as Papelerías Lozano Hermanos, Carvel Print Serigraph, some Toyota dealerships and pharma labs. Similarly Medix, Banco Compartamos and Compusoluciones1 go beyond law requirements attending workers’ vital and personal needs. By recognizing and rewarding employees’ actions, they complement the labor gains built through the years.

Between the lagging working conditions in Mexican haciendas in the XIX century, the extreme conditions experienced today at Chinese factories (shifts of 12 x 12 hr. called “hot bed factories”), the inflexibility of our labor law and the “laissez faire” in which an employee can be dismissed without compensation, there is a common ground: it´s not a point in between, it´s a place, a common ground where it must be possible to build and raise the value for which businesses contribute to society.

IV. Corporate Social Value (CSV) or Corporate Social Responsibility (CSR)

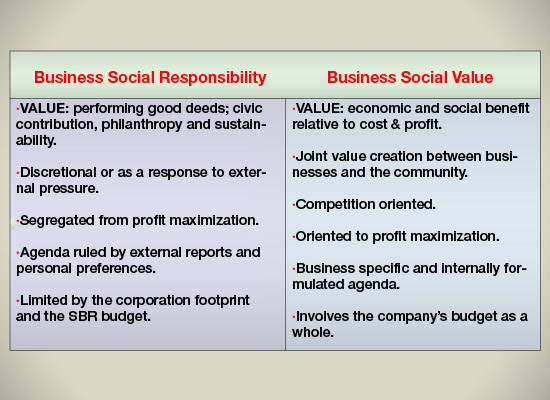

The creation of social business value should overcome corporate social responsibility when orienting companies’ investments. CSR programs are focused on reputation and they hardly maintain a connection with the business core; therefore they make it difficult to justify and maintain long term commitments. In contrast, CSV incorporates company’s profitability and its competitive edge. It gathers unique resources and experience in order to innovate and create economic value when creating social value, henceforth having a positive impact even to potential externalities..

What has been accomplished until now, sustainable housing projects, formation of retirement funds, health services and profit-gain distribution is similar to the Corporate Social Business Value approach suggested by Porter and Kramer1, destined to a more prosper society, with purchasing power, more equal, and able to innovate.

Mexican society must define what goes first: sharing the fruits of productivity by raising salaries, thus lowering risk and interest rates, in accordance to business goals or to remain in cosmetic philanthropic acts of social responsibility. It seems that the former, CSV makes more sense.?

References

Carlos G. Amtmann y Carlos Osuna (2010, diciembre). Estimular el pago por productividad: Un acuerdo nacional para el desarrollo, Dirección Estratégica 35; .

Michael Porter y Mark Kramer (2011, enero-febrero). Creating shared value. Harvard Business Review.

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/valor-social-empresarial/

URLs in this post:

[1] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2011/12/valorsocial_TABLA.jpg.pagespeed.ce_.rElZsHYyre.jpg