Government Financing Options in Mexico

Posted By Ceci On 8 May, 2014 @ 3:00 am In Entrepreneurship,Edición 48 | No Comments

By: Daniela Ruiz, Caroline Auvinet and Claudia González

By: Daniela Ruiz, Caroline Auvinet and Claudia González

Micro, small and medium-sized enterprises (SMEs) are a key element in the economic development of any country. In Mexico, the importance of SMEs lies in the large number of jobs they create and their level of participation in the Gross Domestic Product (GDP).

According to data from the National Institute of Statistics and Geography (INEGI), there are approximately 4,015,000 business units in Mexico, of which 99.8% are SMEs, that generate 52% of the GDP and 72% of the jobs.

Other advantages of SMEs are their flexibility and dynamism, as many assimilate and adapt new technologies with relative ease and have flexible manufacturing processes that enable them to increase or decrease the size of their production in accordance with demand. In addition, the multiplier effects generated at the local and regional level are very significant.

However, there are restrictions that limit the growth of SMEs. Among the most important are the lack of access to financing, weak administrative capacity, poorly trained staff, inability to exploit economies of scale, and imperfect information of market opportunities. Therefore, without government intervention, SMEs have a large number of failures or remain small, and have high transaction costs. This amply justifies government intervention to improve the economic environment and to create conditions that contribute to the establishment, growth and consolidation of SMEs.

In Mexico, there are many government programs that support SMEs. However, there is no evidence of a collaborative effort between various government agencies focused on informing them about the full range and objectives of the programs. Consequently, the majority of SMEs do not know about the right program for the specific needs of their companies or projects, do not know when or how to participate in the calls, and thus miss the opportunity to apply for the appropriate program that could have a significant impact on the productivity and rate of growth of their businesses. Furthermore, government agencies forgo the opportunity to place their resources efficiently in those SMEs or entrepreneurs who could better use them to create value and generate jobs. It is also possible that the lack of coordination between the different agencies results in an unnecessary duplication of efforts and that they overlook the opportunity to link SMEs with support programs elsewhere.

This article presents a brief summary of the governmental programs offered. In June 2013, the date in which the mapping of the government support programs was completed, there were 91 programs focusing solely on SMEs. Excluded from this figure are government programs whose beneficiaries are not SMEs. In this study, the products offered by the Development Bank, specifically NAFINSA, BANCOMEXT and Financiera Rural, were also included.

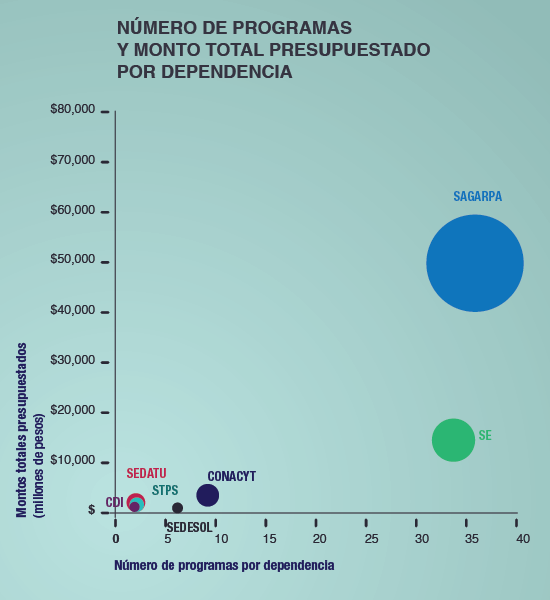

The main results of the mapping indicate that of the 18 Federal Agencies, only seven offer this type of program. The ministries of Agriculture (SAGARPA) and of Economy (SE) account for 74% of the programs, followed by the National Council for Science and Technology (CONACYT) and, to a lesser degree, the Ministry for Social Development (SEDESOL). The transparency indicators for each agency show that the approved budgets do not depend on the number of programs offered. For example, even though SAGARPA and SE administer the same number of programs, SAGARPA has a budget nearly four times greater.

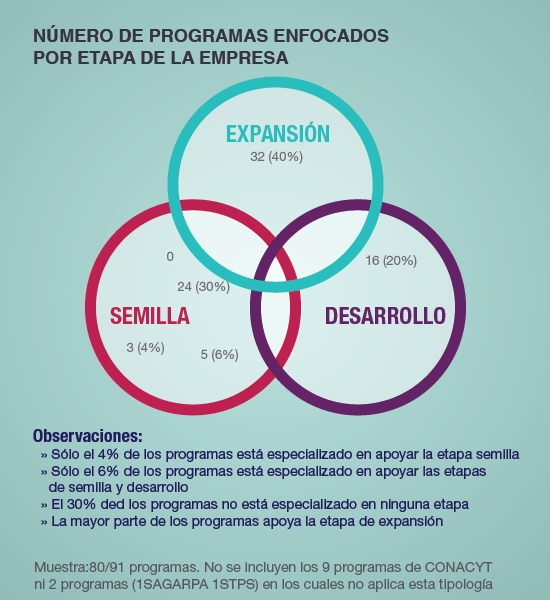

An important conclusion is that the programs do not have a defined policy with regards to the stage of the companies that they want to support. Thirty percent of the programs are not specialized in any stage of the business, but equally support the seed, development and expansion stages. This is not necessarily a good thing, as companies have different needs at each stage of development, and require different kinds of support and expertise. In addition, despite the importance of support for SMEs in the initial stages of creating new businesses, it is surprising that there are only three programs focused on the seed stage, and no more than five in the seed and development stage, while the greatest efforts are focused on supporting the expansion stage.

With regards to the types of support for SMEs, virtually all programs provide non-refundable grants, requesting an average of 30% of matching funds from the beneficiary. Even when the development bank offers various financing schemes and capital, creating other programs that provide support in the form of financing or capital is considered to be an area of opportunity that could be exploited by the federal government.

Another of the obstacles faced by SMEs in searching for and finding the right support program, as some programs do not have updated information, or the available information presents major inconsistencies, especially on the Internet. Furthermore, virtually no program, with the exception of those of SAGARPA, publishes in advance call dates or rules of operation.

To know and better understand the government programs in support of SMEs in Mexico, initiatives that strengthen the impact of the programs, such as the following, should be promoted:

- Include a catalogue and technical specifications of each program on the websites of the various agencies, so that beneficiaries can learn about their characteristics, requirements and objectives.

- Make a concerted effort between government agencies not only to concentrate the information in one site, but also to link the offers of different programs.

- Strengthen support programs at the seed and development stage.

- Strengthen support programs in the form of capital and credit.

- Develop a methodology to rate the performance and impact of the programs.

- Create a shortcut to the existing support programs on the homepage of each federal agency.

- Create an individual page for each program, explaining in an abbreviated manner, its objective, beneficiaries, eligibility criteria and how one can access the program. In addition, this page should disseminate the rules of operation, dates of the calls, transparency reports, list of beneficiaries and full contact information (name of responsible person, address, telephone, email and mailbox for questions).

- Review the online information of budget transparency indicators and the reporting of accounts of each of the programs of the various agencies. Include report figures of rejection of the submitted projects that competed for the programs.

- Update the information of results at the end of each fiscal year.

- Put the results in an easy-to-use format (either Excel or Word) to facilitate the analysis of data.

- Post the rules of operation and the calendar of dates of the calls for all programs that will be offered during the year.

We hope this information will serve our readers to find and become familiar with the ideal government support program for each stage of development of their company.?

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/opciones-de-financiamiento-gubernamental-en-mexico/

URLs in this post:

[1] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2014/05/TABLAS-DE-1-02.png

[2] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2014/05/TABLAS-DE-1-03.png

[3] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2014/05/TABLAS-DE-1-01.png