Microinsurance: A Tool Against Poverty

Posted By Ceci On 14 June, 2012 @ 12:18 pm In Edition 41,Finance | 1 Comment

Introduction

“Microinsurance” is the generic name given to certain type of insurance designed specially to cover some contingencies faced by low-income people. Microinsurances should have special characteristics, such as small insured sums and low premiums. This is because the insured sums should be according to the patrimony of a low-income person, and the premium should be affordable. Another microinsurance key feature is that it should operate with extremely simplified mechanisms that reduce as much as possible administrative costs in order to keep low premiums. (Churchill, 2009).

1. Origins of Microinsurance

In 2005, around 100 worldwide experts met in Germany to analyze and discuss the characteristics, opportunities and difficulties of microinsurance. (Churchill et al., 2006). This meeting was considered as the microinsurance formal entrance at the insurance market. Nevertheless, there are some historical cases in Europe and the United States about similar insurance operations that predate what we know today as microinsurance. (Crawford-Ash and Purcal, 2010). An example is the industrial life insurance based on life insurance policies with small insured sums and weekly premiums collected door-to-door, marketed in the late 1800s by Prudential Life Assurance Society in the United Kingdom and by Metropolitan Life Insurance Company in the United States.

It has not been possible to know the exact origin of the term “microinsurance”, but the term appeared in the content of the next three publications that date back 1999: 1. Micro_Insurance: Extending Health Insurance to the Excluded by David Dror; 2. Synthesis of Case Studies of Micro Insurance and Other Forms of Extending Social Protection in Health in Latin America and the Caribbean; and 3. Providing Insurance to Low-Income Households: Part 1: A Primer on Insurance Principles and Products by Warren Brown and Craig Churchill. It recalls that the term “microinsurance” came from the older term “microfinance.”

2. Role of Microinsurance

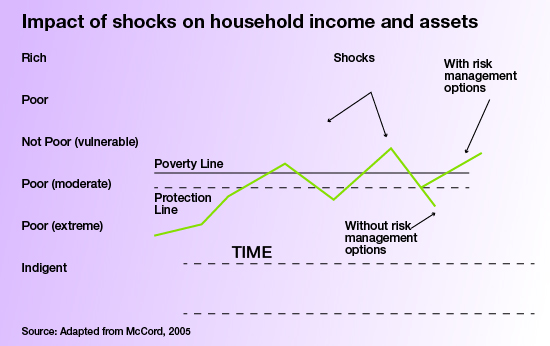

The main role of microinsurance is to serve as an effective tool against poverty, performing as a mechanism to mitigate the impact of shocks1 which could make that, a low-income person, loses his patrimony which likely was made with big efforts.

From a technical perspective, microinsurance can be used as a mechanism to mitigate the variations in the standard of living that a person who lives below the poverty line may face over time, as shown in Figure 1.

Figure 1.

3. The Target Market of Microinsurance

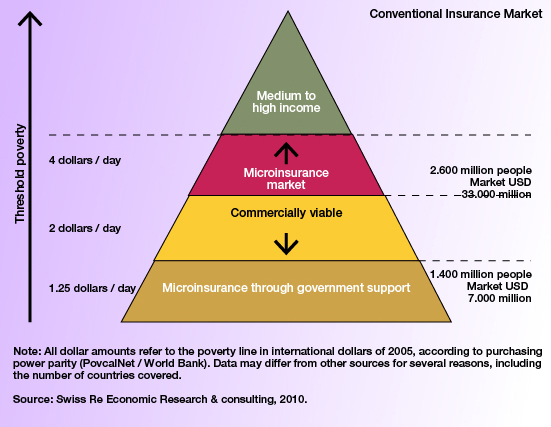

The potential market of microinsurance is poor people in the world. It is a market of about 4 billion people who live on less than four dollars a day. However, in each country the target market depends on the location of the poverty line. (Table 2).

Figure 2.

4. Types of Risks which Can Be Insured by Microinsurance

In general terms, there are no limits of types of risks that can be insured, but it should be understood that the insurable risks are those that impact low-income people. For example, it is obvious that an auto insurance would be an inappropriate microinsurance, because a car is not a typical good of a person with limited resources. The most common risks covered by microinsurance are:

- Death: Microinsurance can cover funeral costs of the deceased person, the orphanhood or widowhood benefits, as well as payment of microcredits granted to the insured.

- Disability. Microinsurance can cover the disabled person family which would be no longer protected, providing aid to children who are minors or a spouse, as well as payment of microcredit debts.

- Illness or Accident. Microinsurance can cover medical expenses due to illness or accident of the titleholder or an economic dependent, as well as provide an income when the head of the household is disabled.

- Loss of Property. Microinsurance can cover loss by destruction, theft or other reason for goods that are important to the insured, such as animals, crops, sales merchandise, house, machinery or tools for work.

1 The term “shock” refers to the economic losses suffered by a low-income person due to an accident, illness, loss of property by natural disasters such as flooding, earthquake, drought or for theft, etc.

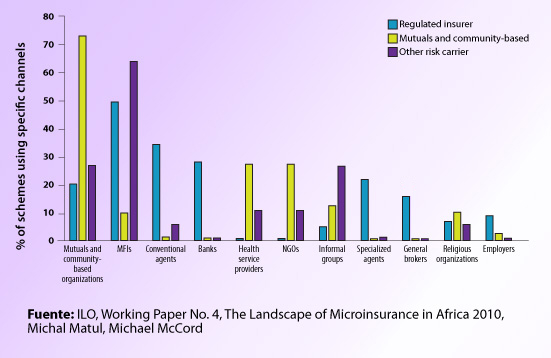

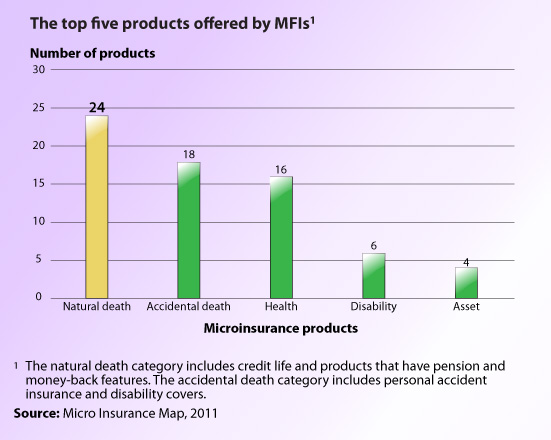

The Microinsurance Compendium from Janice Angove et al. (2011) presents the main microinsurance products offered in the world (Figure 3).

Figure 3.

5. Forms of Marketing and Management of Microinsurance

In microinsurance, the marketing and claims management are different from other types of insurances. First, a mass marketing way is needed to reduce administrative costs. The difficulties lie in achieving low premiums and simplifying the claims procedures as much as possible. These difficulties require a scale economy, innovation, efficiency, simplicity and intelligent risk management. For this reason, Churchill (2006) recommends that in microinsurance operations certain aspects should be taken into account, such as the design of the product and risk management, the appropriate marketing strategy, and simplified procedures in collecting premiums and attention and settlement of claims. In practice, the operation models that have provided microinsurance a greater possibility of development are the following:

- Full service model. This microinsurance scheme is in charge of everything: marketing, delivery of products to clients, claims assessment, etc. This is the model best adapted for a commercial insurance company.

- Partner-agent model. The associate-agent model consists in an alliance between the insurance company and its different commercial partners. It serves to reduce adverse selection, since the insurance company works with the infrastructure, databases and knowledge of its clients to a better risks evaluation.

- Community-based groups. The policyholders are the owners of the insurance company and manage the scheme of mutual associations.

- Provider-driven model. It is used above all for health insurance and is characterized by the insurance company and the health service provider being the same entity.

Figure 4 shows the evolution of these marketing forms of microinsurance in the world.

Figure 4.

6. The Regulation of Microinsurance in Mexico

Mexican regulation, based on the document called “Circular Única de Seguros2“, Title 5, Chapter 5, issued by the National Commission of Insurances, points out that microinsurance must be those which “can be classified in: Life, Property, or Halth insurances, and are intended to provide low-income people with the possibility of insurance protection by mean of the use of low cost distribution and operation.” In the same document, the characteristics of the microinsurance contracts to be marketed in Mexico are set forth. A simplified version of the contract must be used and that the maximum amount of premiums and insured sums must be indicated.

7. Worldwide Microinsurance Development

The number of people covered by microinsurance has increased by nearly 6.5 times in five years. The microinsurance schemes increased considerably during that time and currently they benefit about 500 million people, according to the Innovation in Microinsurance Fund of the International Labor Organization and the Munich Re Foundation. The second volume of the guide “Protecting the Poor. A Compendium on Microinsurance” says that the number of people covered by microinsurance increased from 78 million in 2007 to 135 million in 2009, reaching the figure of 500 million, according to the most recent survey published in those documents.

8. Development of Microinsurance in Mexico

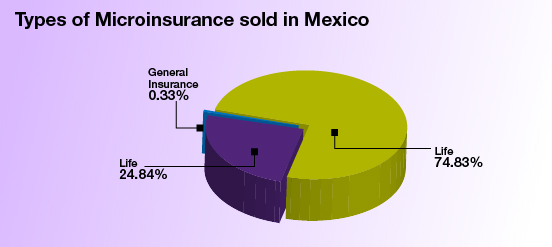

Microinsurance started formally3 in the Mexican market in 2006. In spite of experiencing significant growth, microinsurance development is still incipient. According to the Finance Ministry, the number of microinsurance policies sold until April 2010 was 4.4 million, of which 93.1% are life insurance, 4.5% casualty insurance, and 2.4% personal accidents. From 38 authorized life insurance companies, 34 participate in microinsurance, but the only ones that have high sales are: Banamex, Mapfre, Argos, Azteca, Atlas, GIR, ZURICH and Metropolitana.

Up to now, the microinsurance distribution channels have been those linked to credit schemes. Electra (Electronic Devices Company) has the lead with its system of household appliance sales: it associates the credit with the microinsurance and has two million microinsurance policies sold and insured with the Azteca Insurance Company. Banco Compartamos had linked one million of credits with life microinsurance supported by Mapfre. Fifteen microfinancers linked to Pronafin have sold 43,084 life insurance policies in two years with the co-insurer organized by AMIS. Bansefi and the Red de la Gente have sold 130,000 policies and the Red Solidaria de Microseguors Rurales (Redsol), with 60 rural community microfinancers, has sold 115,000 voluntary microinsurance policies. Various insurance companies are addressing other popular savings and credit organizations directly or through intermediaries like Paralife. In new projects, the possibility of resorting to Telecom, Pronósticos Deportivos, IMEMigrantes, Programa Oportunidades and the receipts of CFE as distribution channels is being analyzed. At the present time (2012), there are a total of 8 million policies in Mexico, according to the Mexican Association of Insurance Institutions (AMIS) (Figure 5).

Figure 5.

9. Conclusion

Microinsurance is a tool to combat poverty and promote economic development. Its introduction has given a big boost to the insurance industry. If it was successful in Africa and India, it is beginning to show signs of growth in Latin America. The development of microinsurance requires special measures from government, both to regulate as well as establish financial support programs. When used properly, microinsurance can be a powerful tool for combating poverty in developing countries.?

References

Center for Financial Inclusion at Action International (2009), “Perspectivas para México de inclusión financiera integral”, septiembre, 3-5 y 23-32.

Churchill, Craig (2009), Protegiendo a los pobres. Un compendio del microseguro, Ginebra: Munich Re Fundation, ILO.

Churchill, Craig, Reinhard, Dirk, y Gureshi, Zahid (2006), Microseguro, un seguro que sirva a los pobres, Ginebra: Munich Re Fundation, ILO.

Crawford-Ash, S. y Purcal, S. (2010). “Microinsurance: Insights From A Historical Approach”, Australian School of Business Research Paper No. 2010ACTL06, 1-45.

Kalra A. (2010). “Microinsurnace-risk protection for 4 billion people”, Sigma, November, 9th.

2Circular única de seguros,” Chapter 5.1 of the insurance products registry

3In 2006, the regulation of microinsurances in Mexico was begun and what is understood as microinsurance for regulatory purposes was formally defined

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/los-microseguros-instrumentos-de-lucha-contra-la-pobreza/

URLs in this post:

[1] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2012/06/Microseguros-021.jpeg

[2] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2012/06/Figura-01-01.jpg

[3] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2012/06/Figura-02-01.jpg

[4] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2012/06/Gráficacorreccion-041.jpg

[5] Image: http://direccionestrategica.itam.mx/wp-content/uploads/2012/06/Figura-05-02.jpg