Public-Private Partnerships to Promote Infrastructure Development in Mexico

Posted By Ceci On 1 July, 2013 @ 9:00 am In Edition 45,Finance | No Comments

By: Gerardo J. Weihmann I. and Esteban Figueroa P.

By: Gerardo J. Weihmann I. and Esteban Figueroa P.

The recent global financial crisis that began in 2008, has aroused increasing interest in alliances between the public and private sectors, not just in developing countries, but in developed countries as well.

The demand for better risk management1

in developing countries, in both the private and public sectors, is rising and will probably continue to do so, fueled by factors such as:

i) the growing integration of developing countries in the global economy;

ii) the increased opening of the economies of these countries to trade and financial flows;

iii) the tremendous volatility of parameters crucial to the global economy-commodity prices, exchange rates and interest rates, among others;

iv) the development and growing complexity of financial derivatives like futures, forwards, options and swaps;

v) the changing involvement of the governments of developing countries, which are acting less as direct participants in transactions with the rest of the world and more as facilitators of those transactions, leaving companies to negotiate among themselves on international markets.

The recent global financial crisis that began in 2008, has aroused increasing interest in alliances between the public and private sectors, not just in developing countries, but in developed countries as well.

Many countries, especially developing ones like Mexico, face a pressing need for high-quality infrastructure and public services. In these countries, a substantial amount of public funding has been invested to increase and improve services for society.

Despite these efforts, there are still considerable shortages of infrastructure in sectors like energy, transportation, housing, health, education and public security (penitentiaries)2. The perennial lack of public-sector budgetary resources, at times combined with inadequate planning, selection and administration of projects, led the World Economic Forum to rank Mexico 53rd in its Global Competitiveness Index 2012-2013, and 68th in the infrastructure component.

1 Uncertainty exists when we do not know for certain the result of a future event. Only uncertainty that affects the welfare of a given party can be considered a risk.

2 In some countries, there are specific sectors that are not included in the definition of the PPPs, like telecommunications, because they are already efficiently regulated or because the private sector is already heavily involved. In other countries, the definition excludes certain types of agreement in which, for institutional reasons, there are substantial limitations on the transfer of risk.

What is a public-private partnership (PPP)?

Some of the characteristics of infrastructure assets that are appealing to private investors are their very long-term horizons, relatively stable revenue flows, generally adjusted for inflation, relatively consolidated markets, potentially attractive yields and limited competition.

Public-private partnerships have become an increasingly popular resource for a growing number of countries that seek to take advantage of these characteristics of infrastructure assets.

There is no universally accepted definition of the term “public-private partnership” (PPP). The term describes a range of possible relations between public and private entities in the context of the supply of public services and infrastructure.

For example, Mexico’s Law on Public-Private Partnerships defines a PPP project as one carried out under any scheme to establish a long-term contractual relationship between government and private enterprise, to provide services to the public sector or to the end user, through infrastructure supplied fully or partially by the private sector, for the purpose of improving social welfare and investment levels in Mexico.

PPP projects also include those carried out under any type of partnership to develop productive investment, applied scientific research or technological innovation.

3

Mexico’s Law on Public-Private Partnerships requires that projects of this type: i)are fully justified; ii) specify the social benefit they seek to generate; and iii) have a demonstrable financial advantage over other forms of financing, particularly over the alternative of the federal government developing the project on its own.

Public-private partnerships allow the involvement of the private sector but recognize and structure the role the government must play in ensuring they meet the corresponding social obligations, and that the necessary reforms are made to the sector, along with the necessary public investment.

The Asian Development Bank has stated that the primary motivations for governments to participate in PPP for infrastructure and service provision, are the following:

- To attract private investment that can help complement limited public resources or free up taxpayers’ resources for application to other needs. Infrastructure services are frequently supplied inadequately, and sometimes require subsidies that involve an additional loss of public resources that could be used to satisfy other pressing needs of the population. The private sector, for its part, participates in the PPP to obtain a return on invested capital that is attractive in proportion to the risk incurred.

- To increase the efficiency and use of scarce public resources, because the public sector often has fewer incentives to incorporate the concept of efficiency into its organization and processes. In contrast, private enterprise’s goal is maximizing its wealth, which implies it will try to maximize efficiency in both investments and project operation. This efficiency is also likely to improve the quality of infrastructure services, and make those services economically sustainable at prices accessible to the population, even after satisfying the requirement of financial return for the private entity.

- To use the public-private partnership as a catalyst for reform in certain sectors of the economy, in which the existence of PPP is just one of the conditions necessary for carrying out those reforms, by reassigning functions, incentives and responsibilities among the different participants with the goal of eliminating possible conflicts of interest.

By establishing contractual relationships and structures appropriate for financing, each risk is reassigned to the entity best able to manage it, which leads to a better alignment of incentives with the efficiency objectives of each project.

Public-private partnership projects have different funding structures for their construction, operation, maintenance and conservation, depending on the country in question. In Mexico’s case, financing is a combination of public resources (federal budget or non-budget funding, like the National Infrastructure Fund) and private resources raised on the debt or venture capital markets, on which the government may often impose a minimum equity percentage.

The contribution from the government may be either monetary or in-kind, as is the case with rights-of-way. In other countries, self-financing projects are common, in which the funding comes only from private contributions or from the revenues generated by the project itself.

3 Articles 2 and 3 of the Law

PPP as an alternative for the development of infrastructure in Mexico

Given the need to increase private investment in Mexico, new institutional and evaluation mechanisms have been created to encourage greater private-sector participation in long-term public projects that generate a net benefit to society.

Among recent efforts to address these needs through PPP are the publication of the Law on Public-Private Partnerships and its Regulations in the Official Gazette of the Federation (D.O.F.) in the year 2012, and the “Manual establishing the Provisions to determine the Social Return and the Advisability of carrying out a Project under the Public-Private Partnership Scheme” published by the Ministry of Finance and Public Credit (S.H.y C.P.).

The following are some ways in which the PPP scheme may contribute additional value to an infrastructure project:

- By providing private sector services, the project may bypass restrictions that reduce the public sector’s degree of freedom, which opens a range of possible solutions.4

- By encouraging a more detailed and precise analysis of the infrastructure projects5 and a better selection of projects, to permit the private entity to maximize its financial returns.

- Infrastructure projects can be carried out on time and within budget, which is more difficult to achieve if the project is carried out as a traditional public work.

- The private sector becomes a facilitator of new technology and innovation both during the construction phase and during the operating phases, which often increases the amount and quality of supply of public services.

- They pave the way for the development of local know-how in the private sector, through alliances with major multinational companies.

- New sources of project financing and revenue are accepted, which makes it possible to collect tolls or fees from the users of that infrastructure.6

- They often lend an element of greater certainty to budget planning, because they specify project outlays not just for the present but for the future as well.

- They encourage the application of the principles of corporate governance to infrastructure, as well as more appropriate regulation of infrastructure. In Mexico, there is still a great deal of room for improvement in private corporate governance.

- Contingent costs are transferred to the private sector and taxpayers resources are freed up for other purposes. They facilitate the application of the concept of value-for-money during the phase of project structuring and evaluation.

- The PPP is flexible, because it can be applied not only to greenfield projects (ground-up infrastructure), but also to improvements or expansions of existing infrastructure (brownfield).

4 The PPP scheme, by avoiding some controls, may also originate future problems that are not always foreseen at the outset.

5 Among other methods, there is a matrix detailing every risk, the entity responsible for absorbing it, and the way it will be managed. The PPP contract incorporates elements of that matrix to ensure its strict execution. The use of the risk matrix is a standardized practice in other countries and is promoted, among other entities, by the World Bank.*6

6A major risk in this type of project is that the public objects to paying the toll or rate.

Risk allocation in a Mexican PPP

The risk conditions of investment projects that are guaranteed by a flow of revenues derived from the project itself, known as Project Finance, require that investors, financial backers and the government assume a role focused more on risk management to reduce cost overruns stemming from speculative risk premiums or the obligation for one of the parties to absorb monetary consequences, with unforeseen financial results. PPPs can be considered a form of Project Finance.7

Some of the characteristics of a Mexican PPP are the following:

- The structure recognizes that the interests of the partners are different: the government has a social interest, and the private sector a financial interest.

- The incentive is for long-term business.

- They promote the involvement of a range of participants (builders, operators, banks, promoters, investors, infrastructure developers, insurance companies, and consultants), both domestic and foreign.

- They recognize the changing risk profile for each phase of the project. Each participant is best able and willing to absorb some specific risks.

- An effort is made to control initial risks; for example, in the case of highway infrastructure, construction risk.

- This scheme creates rules for regulating uncertain variables in the concession period, like natural disasters, suspensions, expansions and new projects.

The case of Mexican highway infrastructure

One of the sectors in which the PPP scheme has been most in vogue for many years is highway infrastructure, given its strategic importance, in which it facilitates Mexico’s connectivity and competitiveness, promoting economic growth, jobs and social welfare.

In 1940, Mexico had a little less than 10,000 km of highways, so the federal government strategy at the time was to connect state capitals and the largest urban areas of the Mexican Republic with highways. Thirty years later, the national highway network totaled almost 72,000 km.

In the 1970s and 1980s, the strategy focused on interconnecting smaller urban centers with rural areas through highways built with lower technical specifications, and by the year 2000 the highway network had grown to 323,000 km.

With the arrival of NAFTA and the globalization of goods, services and financial markets, the goal became building new high-tech highways that linked the main centers of domestic economic activity in Mexico and routes to offshore markets, which substantially shortened distances, transportation times and costs, to make the country more competitive in this new globalized climate.

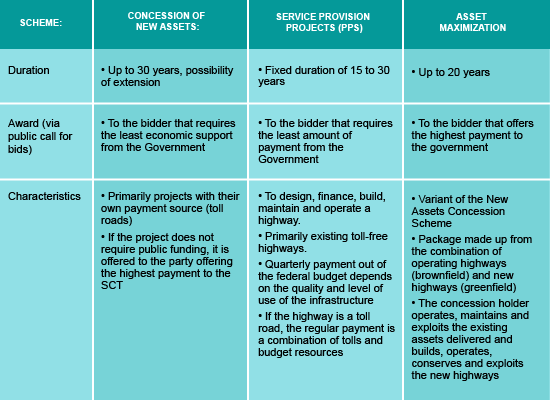

By the end of 2011, Mexico’s highway network consisted of more than 372,000 km of roads.8 The Ministry of Communications and Transportations (SCT) estimates that the country requires around 60 billion pesos a year for maintenance, modernization and construction of new roads. Because the federal government does not have the funding to meet this total need, the SCT has designed and implemented three different types of public-private partnerships:

- Concessions

- Service provision projects

- Asset utilization

7In Mexico, up until the 1970s, almost all the financing of major public works came from government coffers. In other countries, on the other hand, during most of the history of industrialization in the modern world, almost all the financing for very large infrastructure works for public services came from private capital. It was not until the end of the 19th century that public funding became more dominant. This trend continued through almost all the 20th century, but since the start of the 1980s, private funding of major infrastructure projects has become increasingly popular again, and increasingly takes the form of what is known as Project Finance.

8Comparing the total length of Mexican highways with Germany, the latter has approximately 650,000 km of highways, 100% of which are paved, while only 50% of Mexico’s 372,000 km are paved. If we look at the indicator of the number of kilometers of highway per square kilometer of territory, Germany has 7.8, while Mexico has only 0.2.

PPPs are not the solution to all of Mexico’s infrastructure problems

By transferring some risks to the private sector, which has the capacity and is willing to absorb them, and sharing other risks between the two sectors; facilitating a more intensive use of assets with the resulting reduction in fixed unit costs; making government payments conditional on the contractual compliance with certain quality standards in the service; and better identifying and estimating the costs and needs for future financing, among others, PPPs can contribute greatly to economic and financial efficiency.

However, the PPP scheme is not necessarily a sure path to all these potential benefits. Some of the limitations of PPP schemes are the following:

- Financing is available only if the cash flows from the project provide an attractive financial return for the private investor.

- Some projects are more difficult to finance, particularly if there is no tested technology or if the obligations of the private sector have not been clearly identified.

- Some projects do not have the capacity to generate foreign currency revenues9, so they are more subject to of the local financial market restrictions and limit access to foreign capital.

- A poorly structured PPP project may encourage corruption in the short-term and complicate infrastructure management in the long-term.

- If the project is difficult to carry out for political reasons, when a social group feels that its interests are in jeopardy, tolls may have to be increased to obtain the necessary financial return, and this could result in a shrinking of the market.

- Because there is always a possibility that the private sector may acquire know-how and experience in the PPP scheme after the initial learning curve, it acquires an advantage over the government, which is the regulatory entity. The private sector will only meet the performance requirements it is paid for.

- The private sector, especially the project’s financial backers, tend to be even more cautious about accepting high-impact risks that they do not control, like exchange rate risk. They therefore charge higher interest rates, lend for shorter terms, and increase and/or restrict credit conditions. This situation could lead to an increase in the tolls or rates charged for the services and a resulting decline in the financial return of the project.

- The PPP scheme may fail if the government, at some point during the execution of the project, modifies the legal framework, which is the inalienable right of governments.

- The use of the PPP scheme may substantially reduce the government’s degree of future flexibility in the future. Since PPP’s may create long-term contingent fiscal obligations, it is more difficult to estimate the true future fiscal cost than with other more traditional schemes with established upfront payments. This contingency element of the PPP could increase the temptation to invest in more infrastructure today than would be fiscally prudent, as has happened in countries like Portugal and the United Kingdom.

For these reasons, among others, PPP schemes are not always the best option for the provision of infrastructure and public services. They must therefore be evaluated on a case-by-case basis. This evaluation must incorporate the following analyses:

- Proof of socioeconomic profitability, with tools like the preparation of a factsheet (for projects requiring an investment of less than 50 million pesos, or maintenance of less than 150 million pesos), cost-benefit or cost-efficiency analysis, if the benefits of various alternatives are the same or when they are difficult to quantify in monetary terms.

- Eligibility analysis, to determine in the very early stages of the project, its potential for development under the PPP scheme. This analysis includes calculation of an eligibility index10 This analysis is necessary, but not sufficient, to implement a PPP. The project must also demonstrate that the private alternative is superior to the public alternative, through a value-for-money analysis.

- Risk analysis, (identification, assessment, allocation and mitigation), which is obtained from a combination of the probability of occurrence of an event and the gravity of its impact.

- Public-private comparison analysis, to evaluate whether it would be more appropriate to develop the public project as a PPP or as a traditional public work, applying the value-for-money concept.

9For example, airports and seaports have more capacity to generate foreign currency flows than infrastructure projects related to, for example, the water supply.

10 10 This index is based on a structured questionnaire (30 questions) that weighs five factors: institutionality, stakeholders, complexity, macroeconomics and competition; the last one made up of two sub-factors: public bidding and size. The value of the eligibility index goes from 1.0 (definitely not appropriate for development under a PPP scheme) to 5.0 (definitely appropriate for development under a PPP scheme); a score of 3.0 means either option is equally valid.

Conclusions

The public-private partnership scheme has become increasingly important as a complement to traditional public investment; however, it will never replace the role that the government must play, because the involvement of the private sector is not always appropriate or even viable in infrastructure projects and public service supply. We must always bear in mind that the ultimate responsibility of the government is continuous and nontransferable, and society will continue to hold the government accountable for the quality of public services.

In Mexico, the increasingly broad and detailed requirements for determining eligibility of a PPP scheme in comparison to other schemes, established in the new Law on Public-Private Partnerships and the provisions issued by the Ministry of Finance and Public Credit for public-private partnerships, among others, enable planners to know and understand from the earliest phases of the project, the variables and criteria that must be considered when supplying infrastructure and basic services to society. The increased depth and breadth of analysis and greater awareness of each variable’s impact on the project’s development helps agents to make more effective and efficient decisions in later phases.

Given the complexity of infrastructure projects and their very long-term horizons, it is practically impossible to identify all the contingencies that may arise, like acts of God or force majeure, so they are either not specified in the original contracts or they are provided for on a very general level, which leaves room for the possibility of conflicts and interpretation between the participants. For this reason, it will be necessary to make the contracts flexible and leave open the possibility of renegotiating them.

The recent global crisis that began in 2008 because of the subprime mortgage crisis in the United States proved once again that an in-depth analysis of assets, including infrastructure projects, is more important than analyzing the components of capital structure (debt and owners equity), because even though the value of all tangible or intangible assets is given by the net present value of expected future cash flows, meaning that to maximize that value the denominator-financing cost-must be minimized, the most important valuation element is the numerator, which implies that the most appropriate selection of the asset or project.

The greatest opportunities for extraordinary financial gains (financial or economic)11 lies in the choice of assets in which to invest; in this case, in what type of infrastructure projects. Even with the imperfections of the market, this corroborates the importance of Franco Modigliani and Merton Miller’s first theorem regarding the “irrelevance” of the capital structure.?

11 11 In other words, positive net present value. In the current global financial system it is more difficult to find financing schemes with positive net present value, due to increasing competition and lower barriers of entry in these markets, among other factors, then in the asset markets.

Esteban Figueroa Palacios

CEO of AFH Consultores y Asociados, S.C., a consulting firm specializing in infrastructure planning, financing and administration, as well as public-private partnerships and risk analysis in infrastructure investment. Associate professor of Planning at the UNAM School of Engineering for the last 27 years. Civil Engineering degree from the UNAM; Master of Science degree in Civil Engineering in Infrastructure Planning and Management from Stanford University.

Gerardo Johannes Weihmann Illades

Associate consultant at AFH Consultores y Asociados, S.C., a consulting firm specializing in infrastructure planning, financing and administration, as well as public-private partnerships and risk analysis in infrastructure investment. Associate professor at ITAM for the last 23 years; Professor for the last15 years in the Law School of the Universidad Panamericana. Civil Engineering degree from the UNAM; Master of Science degree in Civil Engineering in Infrastructure Planning and Management from Stanford University; Master of Science degree in Industrial Engineering (Management Science and Engineering) from Stanford University, and Master in Business Administration from the University of Pennsylvania.

References

- Banco Asiático de Desarrollo. Public-Private Partnership Handbook.

- Banco Mundial, PPP in Infrastructure Resource Center. Beneficios y Riesgos de las Asociaciones Público Privadas, 2013.

- The World Bank Institute and The Public-Private Infrastructure Advisory Facility, Public-Private Partnerships Reference Guide; 2012.

- Foro Económico Mundial. The Global Competitiveness Report, 2012-2013.

- Agencia Central de Inteligencia. The World Factbook, 2008.

- Ley de Asociaciones Público Privadas, Diario Oficial de la Federación, 16 de enero de 2012.

- Reglamento de la Ley de Asociaciones Público-Privadas, Diario Oficial de la Federación, 5 de noviembre de 2012.

- Secretaría de Hacienda y Crédito Público, “Manual que establece las Disposiciones para determinar la Rentabilidad Social, así como la conveniencia de llevar a cabo un Proyecto mediante el Esquema de Asociación Público-Privada”.

- Secretaría de Comunicaciones y Transporte, Subsecretaría de Infraestructura, Dirección General de Desarrollo Carretero, Asociaciones Público-Privadas para el Desarrollo Carretero en México. Septiembre de 2011.

- De Buen Richkarday, Óscar; Características y modalidades de las asociaciones público-privadas. Diplomado en APP, Cámara Nacional de Empresas de Consultoría, Instituto Mexicano del Transporte, Universidad Anáhuac del Sur, 2013.

- Weihmann I., Gerardo y Esteban Figueroa P., Reflexiones sobre la infraestructura como estrategia promotora de bienestar. Dirección Estratégica 42, septiembre de 2012. [1]

- Lessard, D., “Financial Risk Management for Developing Countries: A Policy Overview”, en J. Stern y D. Chew, The Revolution in Corporate Finance, Blackwell Publishers.

- Brealey, R., Ian Cooper y M. Habib. “Using Project Finance to Fund Infrastructure Investments”, en J. Stern y D. Chew, The Revolution in Corporate Finance, Blackwell Publishers.

- Bodie, Z., R. Merton y D. Cleeton. Financial Economics. Pearson-Prentice Hall; 2a. ed., 2009.

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/las-asociaciones-publico-privadas-impulsoras-del-desarrollo-de-infraestructura-en-mexico/

URLs in this post:

[1] Dirección Estratégica 42, septiembre de 2012.: http://direccionestrategica.itam.mx/?p=3692