By: José Frank González

By: José Frank González

Debts are not like good wine; they don’t get better with age.

Robert Dickinson, English barrister

How many times have we heard the phrase “A sale isn’t closed until it’s collected?” In effect, the ultimate goal of every financial administrator is to optimize the company’s cash flows, and relates directly to maximizing the company’s value. A steady increase in sales is important, but it is also essential to verify that the buyer has enough money to pay; this will ensure that the primordial purpose of every organization is fulfilled.

Collecting on debts in times of economic stability is difficult enough, but in a time of crisis it becomes a nightmare for many businesses, because they do not know how to approach their clients to inform them that they owe money; some are excessively patient and courteous, while others sin in the opposite direction.

For this reason, besides applying effective collection strategies, recovering accounts begins with an evaluation of our clients to identify and assign limits to the risks. In other words, we must analyze and consider contingencies to somehow quantify the risk that is taken on with each client. In this analysis, the credit area must be in permanent contact not only with the financial area, but also with the commercial area, because if it is true that a sale is not closed until it’s collected, this means that the two departments must coordinate to ensure that there are signed contracts, appropriate hedges, compliance with assigned risk limits, etc. To understand this, we will comment on the essential elements of credit, but given the magnitude of the topic we will not deal in depth with the question of proper risk management.

Essential elements of credit

Credit has three elements: personality, capacity and risk.

1. Personality

Personality, or legal standing, allows us to determine whether not a client is capable of signing a contract with us. There are two types of clients:

- individuals

- corporations, legally incorporated and with sufficient powers.

2. Capacity

- Payment

- Investments: properties, assets, etc.

3. Risk

We know that every credit operation is a risk; but it is a risk we need to take, and we must be aware that we are taking it.

We can define risk as follows:

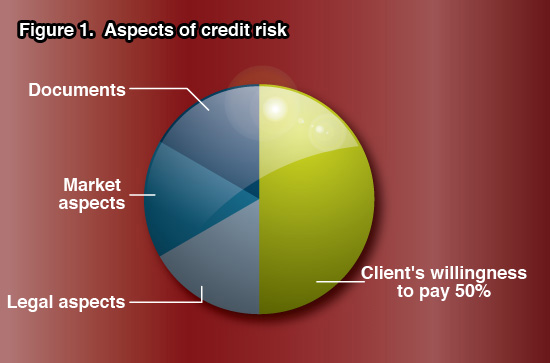

Figure 1. Aspects of credit risk

The customer’s willingness to pay is 50% of credit risk, because even if we have a signed contract or the best credit instrument, at the end of the commercial relationship, a client who does not want to pay will put up all manner of obstacles to delay or avoid doing so.

Legal aspects are also very important, because if they are not properly covered, the risk we take on is even greater.

We must also bear in mind market factors, which are closely related to credit. You must know what type of client our products are going to.

Documentation is also a component of risk. From the outset, we need to know what are the collection elements that we can use to recover the account from our client.

To sum up, in every credit transaction, the following formula sums up what we have just described:

PERSONALITY

+ CAPACITY

+ RISK

Basis for extending credit

The EIGHT C’s of credit research

Today, many companies extend credit to their clients based on the trust they have earned over time and which is reflected in the record of their purchases.

In contrast, there are other companies that try to boost their sales by offering credit based on the information clients may supply in an application or credit form, which may be false, erroneous or not entirely true. In these cases, we need to conduct credit research to corroborate the information and demonstrate not only our clients’ economic solvency but also their moral solvency, in order to be sure that the credit will be recovered for the product or service extended that clients will remain current in their payments. Public accountant Luis Henrique Ruiz Sierra points to eight key factors that should be taken into account when conducting credit research:

- Conduct: moral, history of payment with other vendors, etc.

- Economic Capacity: to pay the full amount of the credit.

- Capital (of applicant): investments, assets and properties.

- Circumstances of the credit: Convenient sale, future market effects, excess merchandise, etc.

- Collateral: Endorsements, guarantees, proposals, etc.

- Criteria used by the analyst to weigh the risks.

- Confidence that the applicant inspires when the credit is extended.

- Collection: communication problems with the client.

Collection Processes

The Collections Department should attempt to follow a friendly process. Collection problems often originate from the moment the credit is recognized.

The collection portfolio can be divided into three parts:

a) Normal collection. This is the collection in which all we have to do is keep an eye on clients and avoid as much as possible any delay in payment.

b) Persuasive collection. This is done with clients that are already late in paying. This is a more direct collection process, intended to prevent at all costs having to resort to legal collections.

c) Drastic collection. When all negotiations have failed, the company must resort to legal collection.

To get an idea of what a delinquent loan portfolio costs, we must calculate portfolio days, which is obtained in three ways: traditional, quick, and by depletion or extinction.

Traditional method

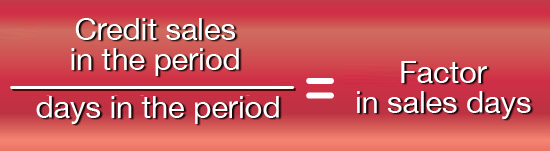

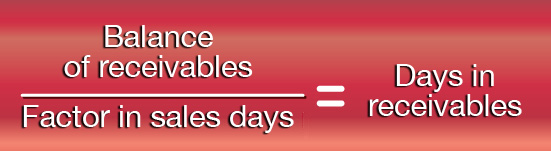

By formula

Quick method

The balance of the portfolio is divided by sales in the period. The result is multiplied by the number of days in the period, resulting in sales days in receivables.

By depletion or extinction

In this method, we take the portfolio balance and begin subtracting sales starting in the current month and going back to preceding months, until completing the portfolio balance. At the end, we add up the days transpired to reach the balance.

After determining the number of sales days in receivables, we can calculate the cost of the delinquent loan portfolio, which, depending on the amount of money we are handling, may be considerable. In this case, top management should be notified of situation, so that they can provide some support with clients whose failure to pay is dragging down the company’s profits.

Basis for effective collection

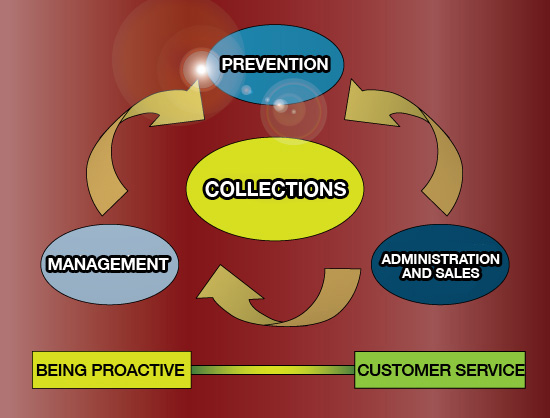

There are essentially three pillars on which an effective collection system is built: prevention, management, and administration and sales.

Figure 2

Ideally, collection should have four characteristics: it must be appropriate, prompt, complete and encouraging.

1.Appropiate

Fundamental recommendations:

- First, collect reports on the borrower:

- Type of clients

- Industries

- Wholesalers

- Supermarkets and private drugstore chains

- Government client

- Consumers

- Record of prompt payment

- Commercial importance

- Type of clients

- Size of the receivable and its current collection phase (reminder, insistence or drastic action).

- Try to investigate the real reason for the delay.

2.Prompt

The failure to promptly carry out steps toward collection is one of the main reasons for over-investment in accounts receivable.

We must make it as easy as possible for the client to meet its commitments, and if the account is late in payment, urge the client to settle the outstanding amount after a reasonable grace period.

Many clients do not pay until they receive the collection call, so we should avoid allowing the lack of initiative and constancy in our collection to serve as an excuse for them to delay their payments.

The difficulty of obtaining a payment or clarification on a receivable, after a certain time, increases in direct proportion to the age of the account.

There are some elements we should be careful of so that we do not contribute to the delay in client payments:

- Comply with the clients’ requirements for accepting invoices for review or settlement. Pay special attention to the new electronic billing system in Mexico, because statistically this factor has been responsible for more than 65% of the delay in company collections in the last 12 months

.

- Keep your client records up to date in the company’s computer system.

- Make sure the invoice contains the correct prices and that the invoice or credit note that complements it specifies any discounts or promotions that apply.

- See that the merchandise was actually dispatched, and if possible, that it was delivered with reasonable speed in relation to the invoice date.

- Avoid passively waiting for the Shipping Department to supply the necessary documentation or for representatives to send the collections they perform.

3.Complete

We should make an effort to settle all of the invoices, except for authorized discounts (supported by credit note) and reduce discrepancies, which may be small compared to the original amount, but added together, could have a considerable impact on our company’s results.

The main reasons for the discrepancies that affect Accounts Receivable are:

- Prompt payment discounts that go beyond the authorized period of time.

- Errors or misunderstandings about normal and promotional prices or discounts.

- Merchandise returned before the vendor receives it, and as a result, issues the corresponding credit note.

- Other deductions that have not been investigated by the person responsible for the collection, or are not communicated to the credit supervisor.

It is very important that we do everything possible to have a slimmed-down accounts receivable portfolio, and to clarify, credit or swiftly charge the differences deducted by our clients so that they do not affect the term of the receivables and sales days in receivables. This is crucial with clients with whom we have many transactions, like supermarkets, because it is difficult, costly and impractical to delve into past files for the information needed to clear up the deductions they have applied.

4.Encouraging

We must place all of our enthusiasm into the collection dialogue, and be insistent and prudent, because maintaining cordial relations with our clients– which can sometimes be affected if we are more insistent than is necessary–is just as important (and sometimes even more) as obtaining the payment. In some cases, it is better to give the client a few additional days to settle an account (if possible, in exchange for a post-dated check) then insist on paying on the date the collection is made, if it damages commercial relations.

The report the Collections Department must always have on hand is the age of receivables report, because it helps that department to determine the real status of the receivables portfolio.

Negotiation

A person who does not know how to negotiate cannot collect. We must be clear on the negotiation procedures necessary for effective and friendly collection. But above all, we must not forget that behind every receivable there is a client to protect. For this reason, it is indispensable to remain calm when collecting an account, because we risk losing a good client. We need to determine what type of debtor we are dealing with: have they inadvertently forgotten to pay the account, or do they simply not want to pay? Depending on the answer, we must define our strategy.?

3 Comments

trabajo en cobranza persuasiva, muchas empresas financieras aun siguen haciendo ventas, por el historial de compran de los clientes, no realizan una investigacion real de compra del cliente,

Información útil y concisa, mucha gracias

Soy analista de recuperación y los problemas que presenta las altas mora es por la falta de capacidad analitica antes de dar el credito y falta de seguimiento del cliente.