Corporate Bank Loans: When Credit Becomes Toxic

Posted By Ceci On 28 June, 2010 @ 8:24 pm In Edition 33,Finance | 1 Comment

By: Renata Herrerías and José Luis Limón

By: Renata Herrerías and José Luis Limón

Mexican enterprises make a Samson-like effort to get off the ground, expand and sometimes just stay afloat in today’s complex, highly competitive and constantly changing economic environment. The risks of failure are high and, unfortunately, ever present. Offsetting them requires ongoing investment in material resources and human capital, plus readily available and adequate sources of financing.

According to the pecking order theory, management will first turn to internal sources of financing to cover the company’s operational and expansion requirements, calling on external sources only when the former run dry. Of these external sources of financing, the option that implies the lowest risk, such as debt instruments, is favored, leaving equity financing as a last resort.

In Mexico, shareholders put up most of the start-up capital, with the cash flows generated by the company supporting its subsequent operation and expansion. Even so, daily operations and, most of all, expansion depend largely on external sources of financing, with bank loans playing a predominant role. But what happens to these funds once they reach the company’s coffers? Are they used properly and in accordance with the commitments undertaken with the bank? When does bank financing herald the beginning of the end for a company

What is the Purpose of Credit?

Simply put, savings and loans are mechanisms that modify the consumption patterns of individuals and corporations. You save so you can consume the same or more in the future and you ask for credit so you can consume more today. An individual applies for a loan so he or she can consume today instead of later and is willing to pay a price (in the form of interest) in order to do so, while a company will need external financing when it wants to expand its operations or when its operating cycles are out of synch. The funds requested should have a specific purpose, create economic value for the company and its owners, and guarantee repayment of the principal and interest.

Bank loans should invigorate a company, much like the effect of vitamins on the human body. When credit doesn’t fulfill these functions and is used to finance activities that don’t add value to the company, it has the complete opposite effect and becomes toxic.

Why Does Credit Become Toxic?

Companies generally have a new generation of financiers at hand who are just as -if not more- capable of assessing a financial problem and its associated risks than bank executives. When the decision to apply for a loan is made, the assumption is that it is clear what use these funds will be put to and the value they will add to the business.

Even when company executives have a notion of how and where the funds will be applied, often they are surprisingly unfamiliar with the nature of the banking business, how bankers reason and the proper management of external sources of financing. A lack of understanding of the various stages in the lending process increases the chances of loan application errors and can result in the poor management of the funds received. The main repercussion will be that the benefits the company expects to reap from the bank loan will gradually fade and, in some cases, disappear altogether. In the final consequence, the loan becomes so toxic it can jeopardize both the borrower and the lender.

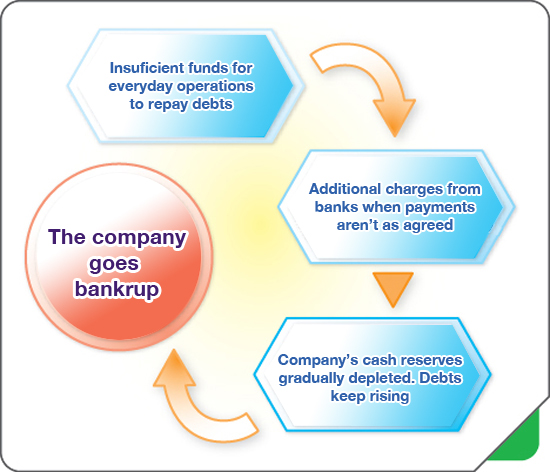

It’s a story we’ve heard all too often: the money isn’t used for the purpose it was requested; the company doesn’t generate additional cash to pay off the loan and stops making payments; when it stops making payments, its debts increase, eventually leading to bankruptcy if these get out of control. A badly requested and badly managed credit line can do a lot of harm to both the company that receives it and the bank that extends it, because it puts the depositors’ resources at risk.

Figure 1. Consequences of Poor Loan Management

Negotiation and Information Problems

Banks are responsible for safeguarding the savings members of the public entrust them with. Their core mission is to transform disperse, liquid assets into financing for productive projects or consumer credit. A banking system can only fulfill this mission by ensuring the money it lends is repaid in accordance with established terms and conditions, and by minimizing risks. These can be reduced or, at the very least, controlled when they are correctly assessed, when the bank has adequate bad-loan reserves and understands the economic environment the loan applicant operates in. The purpose of individual or portfolio credit analysis and risk management is to ensure only those loan applications that entail reasonably acceptable risk are accepted.

The key to good lending is to reduce information asymmetries between the company and the bank, i.e. the bank should know the company as well as the executive requesting the loan does. The purpose of the information the company furnishes the bank with, along with the interviews the bank conducts and its visits to the company, is to minimize these asymmetries and enable the bank to make the best possible decision.

Notwithstanding, corporations usually limit themselves to meeting the bank’s “requirements”. From a corporate standpoint, banks merely want them to fill out application forms, provide supporting documents and clarify certain aspects of the company’s business, generally accounting-related issues. During interviews with the bank executive or when the latter visits the company to gather additional information, this sense of superficiality persists – the bank executive simply asks the company to fill out the necessary questionnaires without requesting further details that would provide a more complete picture of the business and its inherent risks, while the company executive makes no more of an effort to clarify the difficulties of the business, its risks and, more importantly, how these can be offset or reduced.

If company management is not clear about its financing needs and fails to provide a detailed analysis of past performance and growth prospects, then it will be the bank that takes the lead in negotiations. Furthermore, the bank will hold on to this controlling position not just during negotiations, but in defining the credit products it makes available to the company and the terms and conditions of any loans extended.

Companies tend to interact with banks on a very basic level; instead of availing themselves of diagnostic tools to determine their financial needs, they limit themselves to providing strictly the information requested of them, passively accepting the process in which banks are viewed as a “black box” that has to be fed with data, documents and precise answers to specific questions. How banks process this information and reach a decision remains a mystery. In fact, banks are often held to speak a language of their own and possess a mentality that is incompatible the company’s. In making these assumptions, corporations limit their own capacity and ability to negotiate with banks.

To make matters worse, companies are rarely familiar with the full range of products banks offer and which of these is best suited to their needs. And instead of analyzing loan repayment terms and conditions, they are more likely to accommodate themselves to the characteristics of the loan offered them. In other words, it is the bank that calls the shots.

Consequently, the biggest mistake a company can make is to limit the amount and quality of the information it furnishes the bank with. Failing to explain in detail how the business works and provide supporting documentation is counterproductive because the less information the bank has at its disposal, the fewer elements it has to base its decision on, which only serves to limit the company’s negotiating leverage. Conversely, when a company discloses detailed information on its business, this transparency and the in-depth knowledge and understanding it affords bolsters the trust of decision-makers at the bank. Over and beyond the actual loan application, companies would do well to show their enthusiasm by compiling structured reports that convey confidence in their future and the projected benefits of the loan, which, in turn, guarantee its timely repayment.

Other Common Mistakes

- The company accepts loans it doesn’t need. The finance executive encourages management to utilize these available funds and they are incorporated into the company’s assets with no productive purpose in sight. The funds end up being diverted to other ends, such as speculation, lie idle in the form of cash reserves, are tied up in inventory reserves or are used to upgrade equipment in the absence of a clear-cut expansion plan. The main problem with failing to use the money productively and not having an established source of cash generation is that it increases the likelihood the company will not recover the cost of the loan (interest) and, in a worst-case scenario, fail to cover principal payments.

- The company requests or accepts a credit line knowing it does not have the capacity to repay it. Sooner or later, this will come to light when solvency issues begin to arise and if the funds weren’t channeled into productive investments, this will only exacerbate the situation.

- The company does not have a comprehensive understanding of its financing needs. The focus is placed on specific short or long term goals, without taking into account incidentals or day-to-day fluctuations in operating cash flows that have a direct impact on loan payment capacity. Worse still, possible changes in the company’s economic environment and their potential impact on cash flows are overlooked.

- No analysis is conducted to ensure the terms and conditions of the loan coincide with the characteristics of the company’s business as regards: amount, availability, term, method and source of repayment, cost-benefit of the loan, level of commitment and whether or not the guarantees put up are proportional to the funds received. More often than not, cheaper financing alternatives are not even considered, all of which translates into liquidity and profitability problems, reducing the company’s room for maneuver on the operating front.

- The company either lacks or ignores financial controls. Consequently, it has no way of knowing whether the loan was put to productive use and generated value or if it was merely eaten up as expenses.

- In terms of credit management, the company fails to update the bank on its performance, results or changes in its business strategies. It is important to banks to keep tabs on the companies they lend to and the latter should not underestimate the benefits of keeping lines of communication open and maintaining a fresh relationship with their bank, as this will play out in their favor when requesting an extension or a new loan.

- Apathy in the face of arrears. Instead of approaching the bank before falling behind with loan payments to explain the cause and restructure their debts, companies generally wait until it’s too late and the cost of late payment and interest charges have become unmanageable. The mistake here is sitting back and letting the bank conduct a superficial investigation and propose solutions that aren’t always in the company’s best interests.

- Companies sometimes forget that bank loans are the main source of information credit bureaus rely on.

Conclusions

Businesses need bank financing to expand and when these funds are invested in profitable projects whose economic benefits outweigh the cost of the loan, it is not just the company and its owners that stand to gain, but society at large. It is the responsibility of corporate borrowers to reduce information asymmetries with their lenders and use the credit lines extended them responsibly and seriously because at the end of the day, these resources belong to us all. ?

References

Clayman M.R., Fridson M.S. y Troughton G.H. (2008), Corporate Finance: A practical Approach, CFA Institute.

Abrahams C y Zhang M, (2009), Credit Risk Assessment: The new lending system for borrowers, lenders and investors, Wiley.

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/el-uso-del-credito-bancario-empresarial-cuando-el-credito-se-vuelve-toxico/