Control or Not Control… That is the Question!

Posted By Ceci On 19 December, 2012 @ 9:35 am In Accounting,Edition 43 | No Comments

By: Sandra Minaburo

Director, Accounting Research Center, ITAM

Since the time of its founding, one of the core objectives of the Mexican Board for Research and Development of Financial Reporting Standards (CINIF for its acronym in Spanish) has been to promote a convergence of Mexican Financial Reporting Standards (Mexican FRS) with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

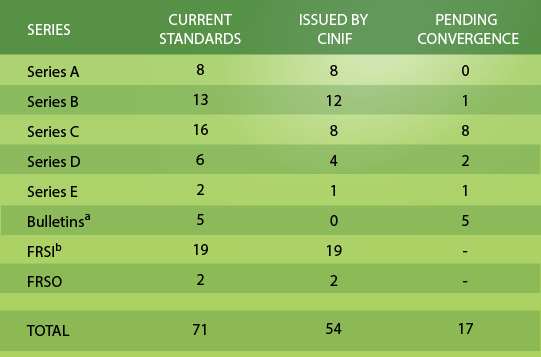

Between January 2006 and December 31, 2011, the CINIF issued 33 FRS, 19 FRS interpretations (FRSI) and two FRS orientations (FRSO), which leaves us with a total of 11 standards still pending convergence.1 Table 1 shows the current status of Mexican FRS based on Standards in effect as of January 1, 2012 (CINIF-IMCP, 2012).

Table 1. Comparison of MFRS issued and pending convergence.

a) The bulletins will be incorporated to the new FRS as they are issued.

b) FRSI 1, 2 and 4 are no longer in effect.

As of November 2012, the CINIF had issued six standards for comment: MFRS B-6, Statement of Financial Position; MFRS C-14, Transfer and de-recognition of financial assets; MFRS B-12, Offsetting financial assets and liabilities; MFRS C-21, Joint Arrangements; MFRS C-7, Associates, joint ventures and other permanent investments; MFRS B-8, Consolidated or combined financial statements; Annual Improvements to MFRS 2013; MFRS C-11, Equity; and MFRS C-12, Financial instruments with characteristics of debt and equity.

Generally speaking, all of these proposed standards converge with international standards, so the differences between Mexican and international standards in these areas is expected to diminish once the definitive standards are released.

Specifically, MFRS B-8 suggests a new concept of control, which had been proposed and accepted in IFRS 10, Consolidated financial statements (IFRS 2012). This concept of control factors in a number of elements that must be evaluated to determine whether or not they exist and thus to consolidate the entity over which that control is exercised.

To understand how the concept of “control” has evolved, it is useful to review its predecessors in Mexican accounting standards. It begins with Bulletin B-8, Consolidated and combined financial statements and valuation of permanent investment in equity, in effect since 1992 (CINIF-IMCP, 2008). Control was defined in paragraph 3, point b), as: “the power to govern a company’s operating and financial policies, in order to profit from its activities.” A parent company was assumed to control a subsidiary when it directly or indirectly owned more than 50% of its outstanding voting stock, unless it could prove that it had waived the power to govern the subsidiary, which it held in one or more of the following ways: i) power over more than 50% of the voting stock through a formal agreement with other shareholders; 2) power derived from corporate charter or formal agreement with shareholders to govern the subsidiary’s operating and financial policies; 3) power to appoint or dismiss most of the members of the Board of Directors, or the body that effectively governs the subsidiary’s operating and financial policies; and 4) formal power to case the deciding majority of votes in the current Board of Directors of body of government.

In 2005, when the CINIF issued MFRS B-7, Businesses acquisitions (CINIF-IMPC, 2012), establishing the accounting treatment for initial recognition of investment in subsidiaries and associates, Bulletin B-8 had to be restructured and modified. Changes were also made to align the accounting procedures for consolidation and its associated concepts with the international standards in effect at the time. The main accounting changes that were made in Bulletin B-8, and which gave rise to MFRS B-8, Consolidated or combined financial statements (CINIF-IMCP 2012) were: 1) the concept of special purpose entities (SPE) was incorporated; 2) the reasons why an intermediate controlling company could cease consolidating were more clearly identified; 3) the existence of potential voting rights were established was made a condition for determining and evaluating the existence of control; 4) the terms “majority interest” and “minority interest” were changed for “controlling interests” and “non-controlling interests;” and 5) non-controlling interests was to be valued at the reasonable value of the net assets of that subsidiary plus goodwill corresponding to that subsidiary at the time of the acquisition.

Most of these changes were in response to the well-known accounting crisis that erupted after notorious cases like Enron came to light, where it became clear that certain entities that should have been consolidated were not incorporated into the economic entity or group,2 and therefore, that the financial situation shown in the consolidated financial statements did not necessarily reflect the true financial situation of the parent company and all its subsidiaries. This gave rise to the concept of SPE, which assumes that an entity that is created for a concrete and previously-determined purpose should be considered an SPE. Some examples of SPEs in Mexico are: Investment Promotion Companies (SAPIs), Market-Listed Investment Promotion Companies (SAPIBs), trusts or other corporations, associations or civil societies created for specific purposes.

A parent company may have an interest in an SPE through equity or debt instruments, trust rights, profit-sharing rights, etc.; in other words, it does not always have to involve a direct ownership in the equity of the SPE.

Provided it could be proven that by their economic essence, those instruments or rights should be considered as equity, the SPE would qualify as a subsidiary, and therefore should be incorporated into the group’s consolidated financial statements, in order to properly reflect the risks and benefits of those entities.

Thus, groups were obliged to re-consider, in light of these new criteria for control and consolidation, whether or not to include new subsidiaries in their financial information. These accounting changes had a major impact on the financial information. Most of these effects were seen in the financial industry, prompting the National Banking and Securities Commission to modify the new accounting criteria applicable to credit institutions (SEGOB, 2012), and particularly criterion C-5, Consolidation of Specific Purpose Entities.

In the draft of MFRS B-8, Consolidated or combined financial statements, originally published on August 31, 2012 and now being circulated in the industry for opinion and recommendations, the CINIF proposes that like IFRS 10, paragraph 3, point d), the principle of control should be applied when an entity has: i) power to direct the relevant activities of another entity; 2) the right to variable returns generated by it investment in the other entity; and 3) the capacity to affect those variable returns through its power in the other entity. This definition allows us to identify the three ingredients that define control: power, variable returns and a link between that power and those returns (figure 2). All three ingredients must be identified in order to clearly determine the existence of control.

Figure 1. The three ingredients of control.

To facilitate the identification of control, investors must be fully aware of the purpose and design of the entity in which they invest, and thus clearly understand why there is a relationship with the other entity, and what is the nature of that relationship: what are the relevant activities, who has the capacity to direct those activities, and what entities are exposed to the variable returns. In other words, they should be able to identify all the elements of the relationship between the entities, in order to decide whether a relationship of control exists or not.

The first ingredient, power, determines whether the controlling entity has the capacity to direct relevant activities by the other entity. Power stems primarily from the following rights: voting rights, potential voting rights, right to appoint or dismiss members of the subsidiary’s top management, right to make decisions that are formalized in contracts, and others. These rights must be substantive, meaning they must effectively give the parent company the capacity to direct the relevant activities of the subsidiary, in order for us to assume imply control of that entity.

Most of the time control can be simply and directly identified. It happens when the parent company owns the majority of the voting rights because it owns more than 50% of the common stock. If the identification is not direct, then we must determine whether the rights one entity has vis-à-vis another are sufficient to hold power over it, and whether there are any barriers that prevent the investor from exercising the identified rights.

Furthermore, the parent company must be exposed to or have the right to obtain the variable returns generated by its participation in the subsidiary, which constitutes the second ingredient of control. Some examples of variable returns are: dividends, interest on debt that exposes the investor to the credit risk of the issuing entity, remuneration for services, commissions, economies of scale, costs savings, synergies and any other return that is not accessible to other investors. In and of itself, exposure to variable returns does not imply control; therefore, we must also find out whether the third ingredient exists.

The third and final ingredient is the capacity to use that power to affect the variable returns, since the magnitude of the variable returns does not in and of itself imply control; the relationship between the power and the returns is essential. An investor that has power over another entity, but cannot benefit from it, does not truly have power over it. When that power is delegated, in other words, when the decision-making rights are exercised on behalf of another party, we must evaluate whether the decision-maker is an agent or a principal in this arrangement. If an investor is identified as an agent, it does not control the entity, and therefore may not consolidate it. These situations are seen frequently in the financial industry, particularly among fund managers, construction industry firms or real-estate companies.

Under this new proposed scheme for determining control, its components must be evaluated carefully and in detail, taking into account all the elements of the relationship between the investor ant the entity, since there are ingredients that at first sight seem easy to identify, but when we look deeper and continue applying the criteria of the proposed standard, we find relationships and options that make it harder to determine control or rule it out altogether. Finally, because the conditions of that relationship may change, the existence of control must be continually evaluated, to define whether the investment in an entity still gives rise to a parent company-subsidiary relationship.?

References

CINIF-IMCP (2008). Normas de Información Financiera (NIF), 3a. ed., México, IMCP.

CINIF-IMCP (2012). Normas de Información Financiera (NIF),. 7a. ed., México, IMCP.

CINIF (2012). NIF B-8, Estados financieros consolidados o combinados, Proyecto en Auscultación No. 068-12, agosto de 2012. México, CINIF. Disponible en:

http://www.cinif.org.mx/imagenes/archivos/auscultacion/NIFB-8_Consolidacion.pdf [1]

IFRS (2012). International Financial Reporting Standards (IFRS) – IFRS 10, Consolidated Financial Statements, IFRS Foundation. Londres, Reino Unido, IFRS Foundation.

SEGOB (2012). Diario Oficial de la Federación, “Resolución que modifica las disposiciones de carácter general aplicables a las Instituciones de crédito”, México. Disponible en:

http://www.dof.gob.mx/nota_detalle.php?codigo=5257837&fecha=05/07/2012 [2].

Article printed from Dirección Estratégica: http://direccionestrategica.itam.mx

URL to article: http://direccionestrategica.itam.mx/control-o-no-control-esa-es-la-cuestion/

URLs in this post:

[1] http://www.cinif.org.mx/imagenes/archivos/auscultacion/NIFB-8_Consolidacion.pdf: http://www.cinif.org.mx/imagenes/archivos/auscultacion/NIFB-8_Consolidacion.pdf

[2] http://www.dof.gob.mx/nota_detalle.php?codigo=5257837&fecha=05/07/2012: http://www.dof.gob.mx/nota_detalle.php?codigo=5257837&fecha=05/07/2012